- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Thursday, May 3, 2018 @ 12:00 am

Alongside the global shift from classical chemical synthesis to biotech approaches in the production of active pharmaceutical ingredients, there has been strong expansion in the manufacturing capacities for recombinant proteins and biologics in Switzerland. This has all happened over the last two decades with attractive framework conditions helping to make the chemistry, pharma and biotech sector Switzerland’s largest export industry.

Jan Lucht

scienceindustries

In 1982, the first biotech drug, a human insulin developed by Genentech and Eli Lilly, was approved by the US Food & Drug Administration in the United States. Four years later in 1986, the first recombinant vaccine for humans (hepatitis B), the first biotech cancer drug (Interferon), and the first recombinant mAb (monoclonal antibody) against kidney transplant rejection received marketing authorization. The FDA approval of the first chimeric mAb (Rituximab, against B cell lymphoma) in 1997 jump-started the development of an ever-expanding range of mAbs for a variety of medical applications. More than 60 therapeutic mAbs are on the market now, with hundreds in the development pipeline. Biotechnology has transformed the way pharmaceutical ingredients are manufactured. It offers an alternative to the classical chemical synthesis of active compounds. Today, eight out of the ten top-selling prescription drugs are products of biotechnology. This trend has shaped the global healthcare landscape and of course the manufacturing environment in Switzerland.

As in other European countries, the development of the healthcare biotechnology sector in Switzerland started in the second half of the 1990s; almost two decades later than in the USA. However, public and private research and development, as well as biotech manufacturing facilities, quickly caught up. Today, Switzerland is one of the central players on the global healthcare biotechnology landscape.

Developing infrastructure in Switzerland

One of the first major biotech production sites planned for Switzerland was the Ciba-Geigy Biotechnikum. Back in 1991 it met with such political and public opposition in Basel that the company decided to build the facility close by in the French town of Huningue. Now owned by Novartis, the site has been regularly expanded and several biotech-based active pharmaceutical ingredients (APIs) are produced there. When the current expansion round is completed in 2018/19, the site will be one of the world's largest biotech production sites.

In 1999, Serono opened its Biotech Center at Vevey, canton Vaud, for or the production of Rebif®, an interferon for the treatment of multiple sclerosis. Now part of the Merck Group, the Biotech Center was enlarged in 2008-2010. The company invested about EUR 300 million to meet the growing global demand for therapeutic antibodies such as Erbitux®, used in the treatment of several cancers, and for a range of biosimilars. With further expansions at its sites in Vevey and Aubonne, Switzerland is now the most important country for the production of biopharmaceuticals within the Merck Group.

Roche, the world's largest biotech company, relies on a global network of manufacturing sites for biopharmaceuticals. In 2004, the company decided to invest about CHF 400 million in the construction of a modern production site for a variety of monoclonal antibodies (mAbs) at the company’s Basel headquarters. This opened in 2007. In 2013, Roche invested a further CHF 190 million to build a state-of-the-art facility in Basel for the production of antibody-drug conjugates. This highlights the faith Roche has in the role of these treatments in future medical practice and its commitment to the Basel site.

In 2014, global biopharmaceutical company UCB opened its first industrial-scale biotechnology production center in Bulle, canton Fribourg, one of the largest and most modern sites in Europe. It was built with an investment of about CHF 300 million and was completed in just 30 months. The facility manufactures Cimzia® TNF-blocker (mAb) for the treatment of immunological diseases. In 2015, CSL Behring started construction of a new biotech plant in Lengnau, canton Bern. The final investment will be about CHF 1 billion and the new plant is scheduled to produce recombinant coagulation factors to treat hemophilia starting in 2020. Another recent large-scale construction project is Biogen's next-generation biologics manufacturing facility in Luterbach, canton Solothurn. Work started in 2016 with an investment of approximately CHF 1.5 billion. The plant is due to come on stream in 2019.

When deciding on the location of a new biotech manufacturing plant, Switzerland offers some key advantages that are cited again and again by key players: modern infrastructure, stable political system, liberal labor legislation, and constructive industrial relations. On top of this, the Swiss educational system offers excellent vocational and educational training and provides a highly-qualified and motivated workforce.

Manufacturing flexibility and speed to market

Switzerland is much more than just an interesting location for the production of recombinant therapeutic proteins. It offers many years’ experience in the chemical, pharmaceutical and biotech sectors and a large pool of skilled experts. There is also a willingness to explore new paths and to combine complementary methods from different fields in a flexible way. This allows for new and more adaptable approaches to the manufacturing of active pharmaceutical compounds.

A case in point is the new strategic partnership between Lonza and Sanofi announced in 2017. It combines Lonza’s expertise in large-scale mammalian cell culture facilities with Sanofi’s strength in developing and launching biologics-based treatments. The collaboration will establish a large-scale facility for monoclonal antibody production at the Lonza site in Visp, canton Valais. Construction started in September 2017 with an initial investment of CHF 290 million. The facility is expected to be fully operational by 2020.

The flexible arrangement is a win-win situation for both companies. The sharing of production capacity will give Sanofi access to additional biomanufacturing capacity if required, to react quickly to fluctuations in demand. For its part, Lonza will profit from marketing its share of capacity as well as any unused Sanofi capacity. This allows Lonza to respond to growing own-customer demand for therapeutic protein manufacturing capacity. This flexible allocation of resources will also help to optimize biologics production capacity across the industry as a whole.

The build-up of mammalian cell culture capacity at Lonza is part of a new, integrated biologicals concept. This provides for a modular, technology-independent, development and manufacturing complex that is capable of supporting activities across multiple technologies; mammalian, microbial, cellular or bio-conjugate, and from late discovery to manufacture. The flexible design makes it possible to offer tailor-made solutions to meet customer's rapidly evolving needs. The responsiveness and the adaptability of the biomanufacturing complex is further enhanced by its integration into the Lonza site at Visp. Key features include a long track record in the use of various manufacturing technologies, a highly qualified workforce, and an established service network. The modular complex is expected to reduce time-to-market by 12 months or more. This gives customers a decisive competitive advantage and significantly decreases the risks surrounding major strategic investment decisions.

Life sciences’ major contribution to Swiss exports

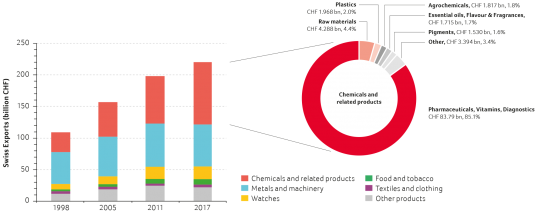

In 2017, exports from the Swiss chemistry, pharma and biotech sector amounted to CHF 98.5 billion. Over the last 20 years, the sector's proportion of total exports has steadily increased from 28.7% in 1998 to 44.7% in 2017. In 2009, it became Switzerland’s largest export industry (see figure below). While total Swiss exports increased by 102% from CHF 109.1 billion to CHF 220.4 billion over the last two decades, the contribution of the life sciences subsector (pharmaceuticals, vitamins and diagnostics, with a significant proportion of biopharmaceuticals and biotech products) soared by 355% from CHF 18.4 billion to CHF 83.8 billion. In 2017, the life sciences industry exports grew by 4.3% and contributed 85.1% of the total exports of the chemistry, pharma and biotech sector. Given current investment in production capacities for biopharmaceuticals in Switzerland, further export growth can be expected in the coming years.

scienceindustries – The Swiss Business Association Chemistry Pharma Biotech

scienceindustries supports some 250 member companies by fostering an innovation-friendly environment in Switzerland, a competitive production and business framework, attractive market conditions and by facilitating worldwide market access. For more information visit https://www.scienceindustries.ch.