- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Monday, May 2, 2022 @ 10:00 am

In many areas of the life sciences industries, biotechnology is playing an increasingly important role in research, development and production. For the most efficient combination of ideas and resources, national and international networking and collaborations are key. Partnerships between all players – academic research institutions, startups, SMEs, and larger enterprises – have a strong tradition in Switzerland, and are important sources of innovation.

Jan Lucht

scienceindustries | Head Biotechnology

For the global healthcare industry, biotechnology has provided innovative approaches for many years. For example, five of the seven top-selling drugs worldwide are produced using biotech processes. Modern life science research has developed treatment options for severe or life-threatening diseases, and healthcare biotechnology thus contributes greatly to quality of life for many people.

Biotech approaches are becoming more relevant for industrial production of chemicals, food and feed additives, and precious flavor and fragrance molecules. They also offer opportunities for a more resource-efficient, sustainable agri-food system, through the development of new sources for food and feed compounds, and by advanced breeding of crops better adapted to future challenges. New technologies, such as genome editing, accelerate the acquisition of basic knowledge in many sectors and extend possibilities for the rapid development of improved products.

New methods and declining costs in the life sciences, along with the rapidly growing potential of computer science, artificial intelligence, data analysis, and automation, are likely to spark a true bio-revolution in the coming decades. The healthcare sector, agriculture, and even the consumer goods and energy sectors could change significantly. A study by the McKinsey Global Institute1, based on an examination of more than 400 potential applications, estimates that over the next two decades up to USD 4 trillion in annual value could be created by biological technologies, up to 45% of all diseases could be effectively cured, and up to 60% of the world's raw materials could be produced by biotechnology.

DARPins: Novel biotech-based therapeutic agents

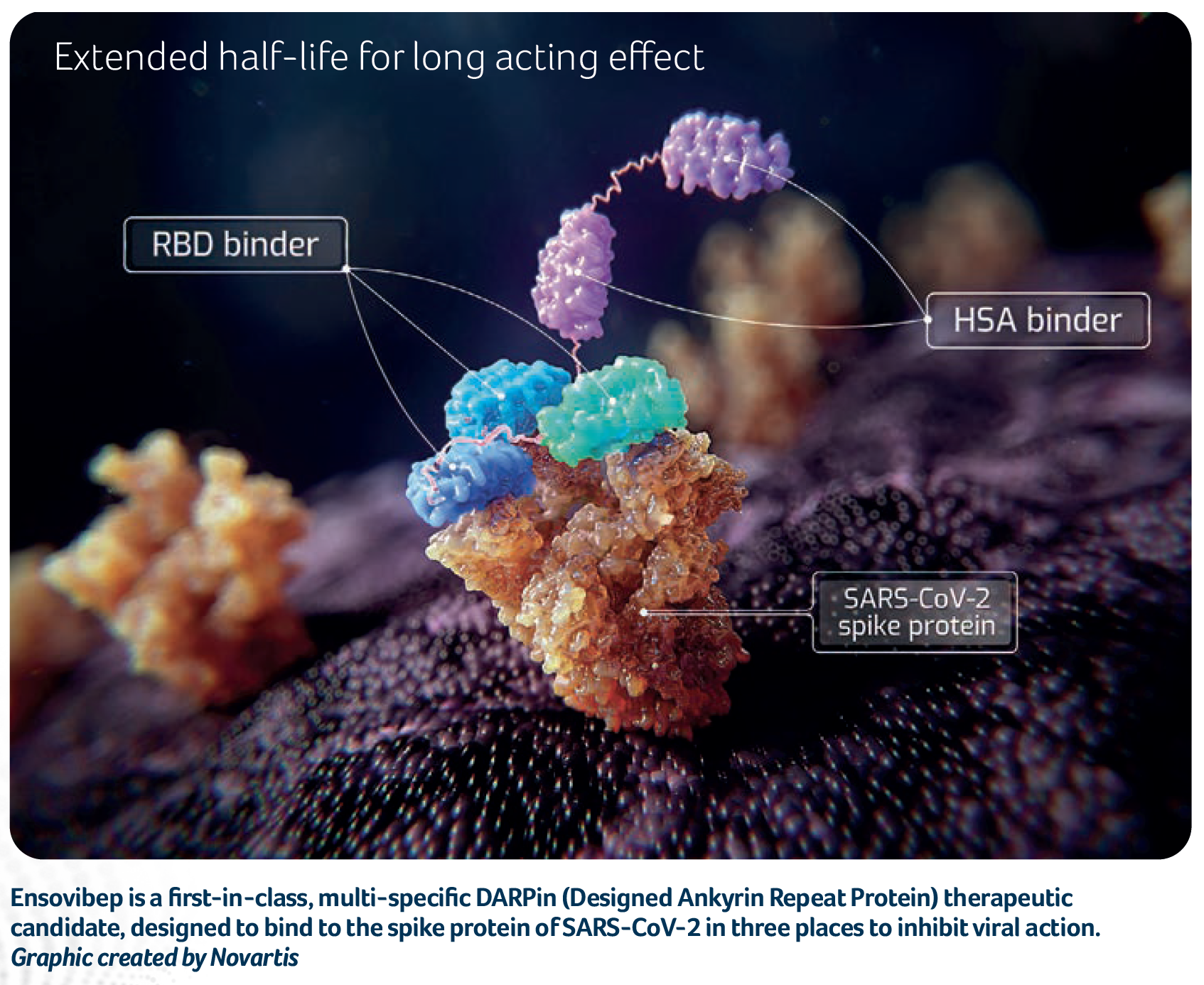

A case in point is the development of DARPins (Designed Ankyrin Repeat Proteins) into promising tools for therapeutic applications. DARPins are artificial proteins that can bind to a variety of antigens, just like antibodies. Because of their small size and ease of expression in microorganisms, DARPins offer important advantages over monoclonal antibodies.

The DARPin technology was conceived by scientists at the University of Zurich, and then continued to be developed by Molecular Partners following a spin-off in 2004. Initial support and funding from the Swiss government’s innovation promotion agency Innosuisse allowed them to expand their research and business activities, and in 2014 the company was listed on SIX Swiss Exchange, followed in 2021 with a listing on NASDAQ. Their work focuses on the development of DARPin-based therapeutics for oncology, infectious disease, and ophthalmology. For several promising projects, they collaborate with major healthcare companies to facilitate the route to market.

In October 2020, Molecular Partners and Novartis announced a collaboration to develop, manufacture and commercialize Molecular Partner's DARP in candidate Ensovibep for COVID-19 treatment. This is a potential antiviral therapeutic designed specifically to bind to the SARS-CoV-2 virus and novel variants with high potency, thereby preventing its entry into human cells. Early in 2022, promising topline results of global clinical Phase II study showed that the risk of serious outcomes of a COVID-19 infection could be reduced by 78%. In January 2022, Novartis exercised its option to license Ensovibep and is now responsible for further development, manufacturing, distribution and commercialization activities.

The collaboration between Molecular Partners and Novartis illustrates perfectly how the competencies of a small, innovative Swiss biotech company complement the extensive research resources and broad experience of a major pharmaceutical company in bringing drugs to the market.

Such synergy will drive the further development of this innovative DARPin candidate which has global potential for helping patients in the treatment of COVID-19.

Sustainable biotech production of flavor and fragrance compounds

In the flavor and fragrance industry, biotechnology and Swiss companies also advance global innovation. In 2014, Firmenich, the world’s largest privately-owned fragrance and taste company, presented CLEARWOOD®. This soft and clean version of a patchouli profile was the industry's very first large-scale fragrance ingredient produced by white biotechnology via fermentation from renewable carbon. In recent years, Firmenich has developed additional biotech fragrance compounds, further expanding their technology expertise and the sensory range of their products.

Givaudan, another global leader in the flavor and fragrance industry, in 2019 presented a new biotechnology approach for synthesizing the most widely used biodegradable fragrance ingredient, Ambrofix. Using renewable, plant-based carbon sources, it requires a hundred times less land to produce one kilogram of the new ingredient compared to the traditional production method. This is only one of Givaudan’s valuable fragrance and cosmetic ingredients produced using biotechnology.

Many innovative fermentation approaches are based on renewable, readily available raw materials, and reduce the use of limited botanical resources, stabilize supply, increase resource and carbon efficiency, and result in a more sustainable production.

Swiss companies are at the leading edge of the global biotechnology trend in the flavor and fragrance industry.

Favorable framework conditions, national and global networks

Successful innovation depends on many factors. Switzerland has an exceptionally strong innovation culture and excellent research in academia as well as in companies is backed by available funding. With expenditures of CHF 22.9 billion for R&D (2019), corresponding to 3.2% of its GDP, Switzerland invests more than most other countries. About two thirds of these financial resources come from private companies, mostly from the healthcare sector.

Promising ideas arising from basic research can be supported on their way to potential market applications by Innosuisse. Larger companies in Switzerland have sufficient resources of their own to push developments forward, and profit from global connections within their organization, but for smaller companies national and international collaborations will be crucial to their success. Many paths exist from basic research findings to practical innovations on their way to the market - the Swiss innovation ecosystem is ideally set up to facilitate this process.

References

[1] McKinsey Global Institute 2020: The Bio Revolution: Innovations transforming economies, societies, and our live