- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Tuesday, April 25, 2023 @ 7:00 am

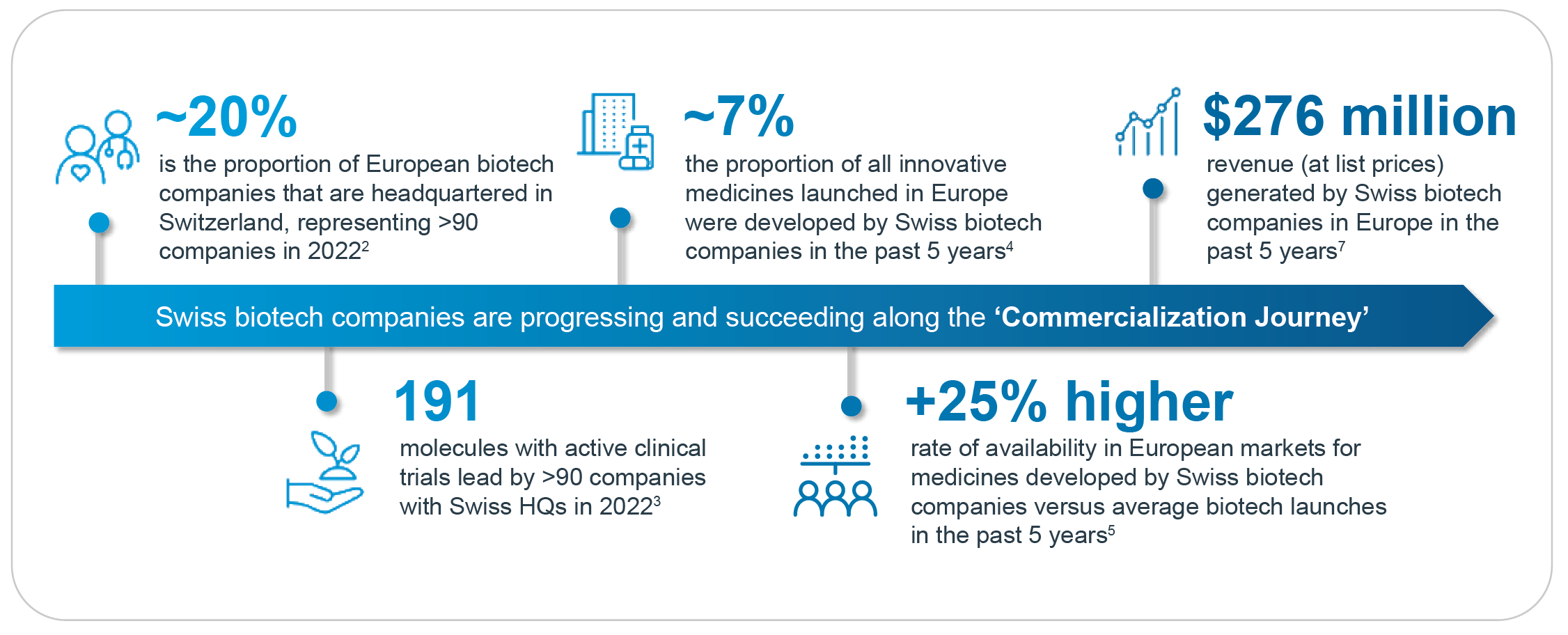

Biotech is the key growth area for pharma and life sciences, and Swiss-based biotech companies play a major role across the entire development cycle, from their share of the pipeline, to clinical trial activity, to the emerging commercialization of new molecules. Switzerland’s ability to drive and nurture innovation is continuing to expand.

Isma Hachi

IQVIA | Biotech Commercial Director

Max Newton

IQVIA | Global Supplier & Association Relations

Emerging biotech companies were responsible for only one-third of innovation in 2002 – by 2022 they provided two-thirds of the R&D pipeline. This doubling of their contribution over the past two decades highlights the increasing importance of smaller companies in driving innovation.1 For example, biotechs now generate over 90% of cell, gene, and RNAi technologies, and are responsible for more than 1’500 oncology medicines in development globally.

Switzerland is playing a vital role in the global biotech sector

Switzerland’s ecosystem provides an ideal location for company headquarters

The Swiss ecosystem is one of the most attractive biotech ecosystems in the world and is built around multiple biotech hubs in the Basel, Zurich-Zug-Lucerne-Schaffhausen, and Romandie regions. About 20% of European life science companies have their headquarters in Switzerland, representing over 90 companies with active clinical trials.²

Swiss-based companies play a leading role in clinical trial activity globally

Over the past decade, the number of clinical-stage biotech therapeutics has grown by 60% to more than 2’500 globally. On a per capita basis, Switzerland’s contribution to the global pipeline is the highest in the world. In 2022, there were ~190 molecules with active clinical trials led by Swiss-based companies, with a focus on oncology, neurology, and gastrointestinal conditions.³

Swiss biotech companies actively contribute to the launch of new medicines achieving world-class success

Biotech companies dominate the pipeline (>60%) and partner with larger firms to account for a further ~7% of the total drug development pipeline. In recent years, the market access landscape has also been Isma Hachi IQVIA | Biotech Commercial Director Max Newton IQVIA | Global Supplier & Association Relations Biotech is the key growth area for pharma and life sciences, and Swiss-based biotech companies play a major role across the entire development cycle, from their share of the pipeline, to clinical trial activity, to the emerging commercialization of new molecules. Switzerland’s ability to drive and nurture innovation is continuing to expand. favorable to biotech companies – around 7% of all innovative medicines launched in Europe in the past five years were developed by Swiss biotech companies.⁴ The number of European markets which reimburse products developed by Swiss biotech companies is 25% higher than the average for non-Swiss biotech companies.⁵

There are notable Swiss examples of biotech companies self-commercializing their innovative therapies without large pharma support

Increasingly, companies have held on to their products to file and commercialize their assets themselves, thereby maximizing the value they capture. Some examples include Alnylam, Mirum Pharmaceuticals and Blueprint Medicines.

Blueprint Medicines, a biotech company with global headquarters located in the Cambridge, US, and international headquarters located in Zug, Switzerland, has developed a first to market therapy, AYVAKYT® (avapritinib), to treat patients with advanced systemic mastocytosis (AdvSM), a rare hematological disorder, with a global prevalence between ~4-5 per million.⁶ Blueprint Medicines has chosen Switzerland, as strategic position, to support the commercialization of AYVAKYT® outside the US.

Although the sector is still considered ‘emerging’, the combined revenue generated by Swiss companies which have successfully launched their molecules in the past five years alone exceeds USD 270 million.⁷

Continuing the success of Swiss biotech into the future

Continued investment

2021 marked a peak in venture capital funding that has not been matched in 2022 at the global level.1 Based on the recently published Swiss Venture Capital report,⁸ the Swiss biotech sector remains fourth in the world in terms of invested capital in 2022 after ICT (Information and Communication Technology), intech and Cleantech.

In 2022, five out of the 20 largest financing rounds were biotech companies, including ImmunOs Therapeutics, a late-stage biotech company that focuses on leukocyte antigens (HLA) to stimulate both the innate and the adaptive immune systems of cancer.⁸

Novel research

Globally, Switzerland and Japan represent a higher share of the late-stage pipeline than early-stage, with companies having more drugs per company on average than in other regions. This indicates that the coming years will be focused on the commercialization of Swiss-led molecules. At the same time, Switzerland’s position as the highest ranked country per capita in early-stage development demonstrates that creating a long-term pipeline has not been neglected.

Switzerland provides a unique ecosystem of highly qualified talent, a diversity of trusted partners, business friendly regulation and accessibility to major academic and innovation hubs around the world. These criteria are key for business growth and among the key factors Blueprint Medicines considered when opening our European headquarters in Zug.

Francesc Almirall Alzamora, Director Commercial Operations & Launch Excellence at Blueprint Medicines.

The growth that we expect to see in the number of first launches is partially driven by the increase in the number of orphan drug approvals. Given the reduced commercial footprint needed to launch in these indications, we tend to see many first launches concentrated in orphan indications. Research shows that of those 10 first launches in Europe, 60% were in orphans over a period when the number of orphan drug approvals has more than quadrupled from 2011 to 2018.⁹

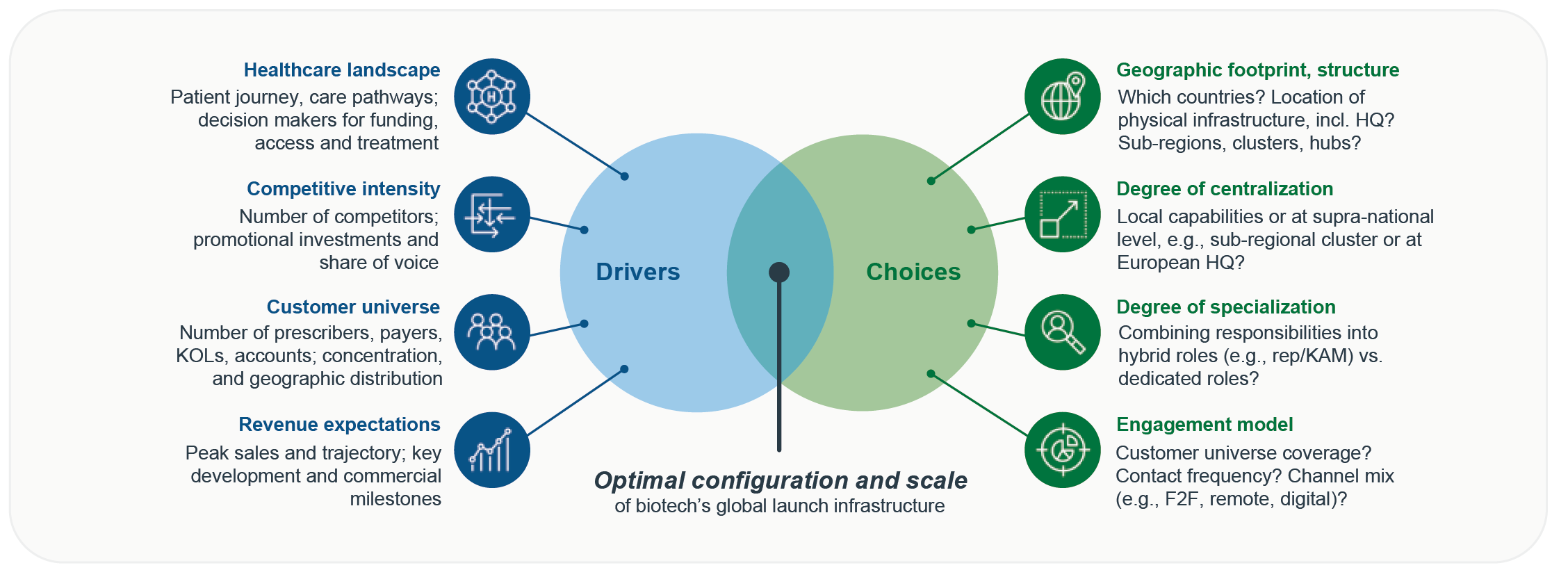

Commercial and market access drivers and choices

It is not uncommon for commercialization to be low on the list of initial priorities for biotechs, with budgets often very limited prior to Phase III readout. Consequently, biotechs tend to be late in starting key commercialization activities and often find themselves having to catch-up and deliver against compressed timelines. This challenge sets up biotech-specific success factors for commercialization such as: the need for flexible cost structures; the ability to ramp-up resource fast to plug capability gaps; and the ability to address the question of the optimal infrastructure model (what are the key drivers and choices to establish an agile and scalable commercial infrastructure?).

In our extensive work with biotech companies, we have observed common infrastructure choices made in preparation for a European launch such as the engagement model, the degree of centralization, the degree of specialization of roles and the geographic footprint and structure. As mentioned earlier, many biotechs based outside Europe choose Switzerland for setting up their European HQ, driven by a business-friendly environment and a deep talent pool, including individuals who honed their skills and gained relevant launch experience at big pharma, or indeed another, commercial-stage biotech.¹⁰

Many drivers determine the requirements for a fit-for-purpose commercial model such as the competitive intensity, the share of the customer universe, the commercial roadmap to reach revenue expectations for the launch and the local healthcare landscape including regulatory changes. In the future, access to new therapies will be impacted by major regulatory changes such as the Inflation Reduction Act (IRA) in the US and the adoption of the legislation for joint European Health Technology Assessment (EU HTA). The intention of new regulations, specifically EUnetHTA, is to establish guidelines but a challenge remains on how to align with the requirements of all Member States.¹¹

Uncertainties related to the development of new regulations and the macro-economic environment will create new challenges and opportunities for all countries, including Switzerland. Switzerland remains ahead of much of the world and a leader within Europe in terms of clinical and development activities, but the continued success of the industry is based on availability of funds, continued investment in research activities, a local support to build the optimal infrastructure and the continued willingness to approve novel therapeutics by international payers. The development pipeline suggests Swiss biotech companies will continue to be at the forefront of the biotech sector and expand their contribution worldwide.

References

1. IQVIA - Global Trends in R&D 2023 Activity, Productivity, And Enablers (February 2023)

2. IQVIA analysis 2022, using IQVIA Institute Impact of Emerging Biopharma Companies whitepaper (June 2022)

3. IQVIA Institute analysis using Pipeline Intelligence dataset, 2022 analysis

4. IQVIA Pipeline Intelligence analysis and HTA-Accelerator dataset, 2022 analysis.

5. IQVIA analysis for HTA-Accelerator and W.A.I.T. Indicator dataset (February 2023)

6. Advance Systemic mastocytosis – Cohen SS, Skovbo S, Vestergaard H, et al. Epidemiology of systemic mastocytosis in Denmark. Br J Haemotol. 2014;166(4):521-528

7. IQVIA analysis 2022, using MIDAS Q1 2022 sales data

8. Startupticker.ch and SECA - Swiss Venture Capital Report 2023

9. IQVIA - Launch Excellence VII

10. IQVIA - Realising The Commercial Promise Of Europe For Emerging Biopharma

11. IQVIA - The future of EU HTA