- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Tuesday, April 25, 2023 @ 7:00 am

In a challenging global stock market environment, companies from the life sciences sector listed on SIX Swiss Exchange continue to benefit from a robust, resilient capital market with comparatively low market volatilities.

Fabian Gerber

SIX Swiss Exchange AG | Senior Relationship Manager Primary Markets

Achieving sustainable success on solid ground

The Swiss stock market has not been spared valuation corrections driven by geopolitical unrest and macroeconomic challenges, and the impact of these factors has been particularly severe in the technology and biotech sectors. Heavy corrections in biotech share prices also reflect their high sensitivity to interest rate changes, which typically have a drastic effect on discounted cash flows (estimates) for biotech companies.

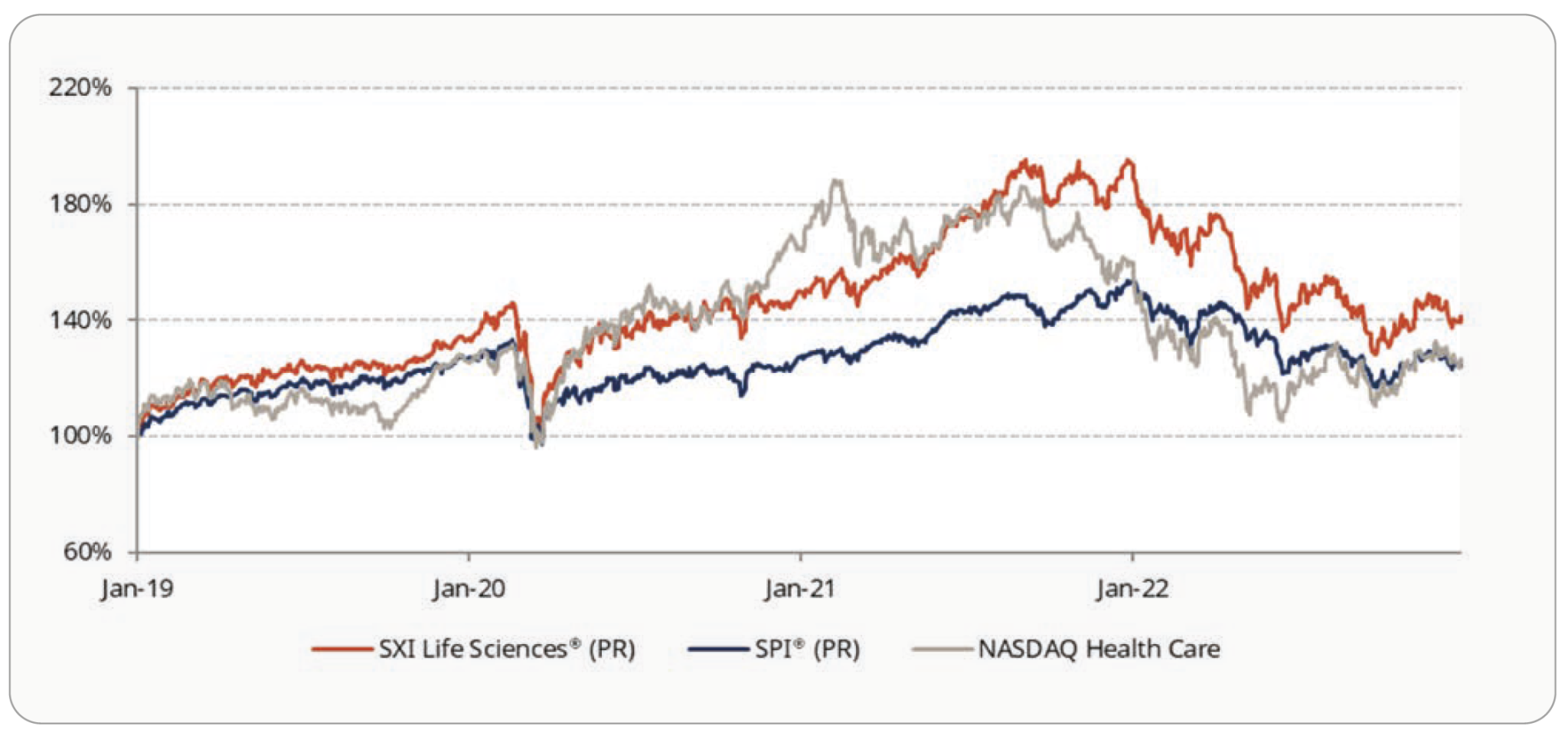

Nevertheless, in these turbulent times, the Swiss life sciences index has held up relatively well, outperforming its US benchmark with both an excess return and lower volatility (see Figure 1). The relative strength of the Swiss capital market demonstrates its quality and stability, backed by a strong currency.

Since January 2019, the SXI Life Science Index has outperformed the NASDAQ Health Care Index by 13.6 percentage points (+39.2% vs. +26.6%) with lower fluctuations in value.¹

These statistics cannot be a coincidence and are proof of the excellent conditions that listed companies find on SIX Swiss Exchange: they benefit from high visibility and a capital-rich domestic and international investor base, and Switzerland’s vibrant life science ecosystem helps them develop and expand their product pipelines in calmer waters.

The difficult market environment in the past year along with the dismal performance of many IPOs listed since 2021 has also had an impact on global IPO activity, which has come to a virtual standstill. Despite these challenging market conditions, two new companies from the biotech sector ventured onto SIX Swiss Exchange last year: Kinarus Therapeutics and Xlife Sciences, the latter of which was the first company to list on the newly launched SME stock exchange segment Sparks.

The strategic importance of the right listing location

Even though IPO activity took a sharp negative turn after a record-breaking year in 2021 with the US being particularly affected, it is unlikely to lose much of its appeal to domestic and European biotech/life sciences companies considering an initial public offering (IPO).

While just over 10% of all IPOs by Swiss companies since 2000 were conducted on a stock exchange in the United States, the choice of the right listing location is particularly relevant to the biotech sector.

The potentially higher company valuations achievable in the US at the IPO stage have often been cited as a reason for choosing to list on a US stock exchange. However, the choice of the right stock exchange for an IPO is a strategic decision and the pros and cons associated with a specific listing location must be weighed against each other. It is advisable not only to focus on the valuation at the time of the IPO but also, particularly in the case of a younger company, to assess whether it will be well placed to create sustainable shareholder value in the years following the IPO, while complying with the requirements imposed on it as a publicly listed company by investors, analysts and the regulator.

Keeping costs under control

The total costs and requirements of an IPO in Switzerland compared to the US should be carefully evaluated. In the US, issuers are required to file a registration statement with the United States Securities and Exchange Commission (SEC). The preparation of the necessary documentation can be a lengthy process, absorbing significant management attention and resources. Equally important are the costs of preparing the business and of operating as a public company. The so-called directors’ and officers’ (D&O) liability insurances have become unavoidable when opting for a US listing, due to the ever-increasing risks and potential costs of securities litigation, and can result in annual insurance fees and expenses in the millions of dollars. In addition, ensuring compliance with the regulatory requirements and obligations of public companies in the United States (e.g. Sarbanes-Oxley Act, US tax law) can further drive costs and must be taken into account.

Download the white paper “Evaluating the aspects of a Swiss versus a US listing”, which discusses the costs, risks and legal aspects of IPOs and shows how a SIX listed company can efficiently access US-based investors, without the need to undergo the time-consuming registration procedure with the SEC.

Ingredients for life-changing medicines and the Switzerland factor

One of the many success stories on SIX Swiss Exchange is Bachem. The pharma and biotech supplier has been listed on SIX Swiss Exchange since 1998 and is an impressive example of the ecosystem for listed life sciences companies. Bachem develops and manufactures peptides and oligonucleotides as active ingredients for medicines. It is considered the market leader for peptides and aspires to reach a significant role in oligonucleotides, as well.

Around 1’300 of its 1’800 employees work in Switzerland. In October 2022 the company announced plans to expand its Swiss presence further - both at its headquarters in Bubendorf (canton Basel-Land) and with a land purchase for a new site in Eiken in the canton of Aargau. The expansion in Bubendorf will see investments of CHF 500 million and up to 800 new jobs in the next three years, while the new site is to go online at the end of the decade with 500 new jobs and investments of CHF 750 million. In 2021, the company turned a historic record turnover of over CHF 503 million with an EBITDA margin of 31.3%. Based on the ongoing demand for its products and services, Bachem aims to reach sales of CHF 1 billion in the coming years and continue to deliver an EBITDA margin of more than 30%.

1 The historical volatility of the last 250 trading days (Jan-21 to Jan-22) for the SXI Life Sciences was around 24%, for the NASDAQ Health Care around 29%.

In the following interview, Thomas Meier, CEO of Bachem, tells us about Bachem’s growth story and the important role played by Switzerland and its life sciences ecosystem.

Thomas Meier

CEO of Bachem

What advantages can Bachem take from the local life sciences ecosystem? What distinguishes the Swiss life sciences ecosystem?

Bachem is focused on chemically developing and manufacturing peptides and oligonucleotides. These are very complex molecules that are increasingly used in a wide range of medicines. The manufacturing technology is constantly evolving. You need a highly skilled labor force, strong partners in academia and an environment that is conducive to new ideas. The combination of strong innovation in both business and academia, and positive regulatory conditions and infrastructure is unique in Switzerland. And we benefit greatly from this environment.

How is the company dealing with the current market challenges?

Actually, the market for our ingredients is booming and we are expanding capacity. So the main challenge is executing on our growth plans. But externally we have seen costs and greater competition in the job market as factors. Here again, we benefit from our presence in Switzerland: a stable currency, moderate inflation and access to the French and German labor force are mitigating factors in today’s macroeconomic environment.

How and with which solutions does Bachem contribute to meeting the global medical challenges?

The ingredients we create for our customers are used in medicines against cancer, diabetes, obesity or rare diseases. Some of these could not be manufactured chemically until recently. So we contribute both toward combating large public health burdens and rare diseases that still have very little treatment options.

What makes you confident that you will achieve your ambitious growth targets? What makes you stand out?

We are not alone in the market and we have a healthy respect for our competitors. This keeps us on our toes. But we like to think that we have a strong focus on innovation and can maintain a competitive lead because of it. There is a strong commitment to quality at Bachem. And we are very dedicated to retaining internal know-how, training and our apprenticeship program. Finally, we think more in terms of sustainable, long-term success.

How important is the listing on SIX Swiss Exchange for Bachem and how does it contribute to the achievement of your growth ambitions?

Bachem is one of numerous pharma and biotech suppliers – or CDMOs (contract development and manufacturing organizations) - located in Switzerland. The Swiss financial market therefore has a strong appreciation and understanding of our business and life sciences in general and understands how our industry works. This has also helped us when raising capital through an equity increase. I think our customers appreciate these principles.