- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Tuesday, April 23, 2024 @ 11:00 am

Biotechnology is a key industry in Switzerland, generating a large number of patented inventions. These are often coauthored with colleagues from international organizations and have a global impact. At the same time, an even larger number of biotech patents from around the world is in force in Switzerland. The present analysis provides a snapshot of the statistics for 2023, covering both aspects. It shows how deeply embedded Switzerland is in the global network of biotechnology innovation and supply, and how the country’s attractiveness as a partner and a startup location is a vital factor in its success.

Christian Moser Nikles

Swiss Federal Institute of Intellectual Property | Patent Expert

David Rees

SwissFederal Institute of Intellectual Property | Patent Expert

Switzerland: an attractive international partner

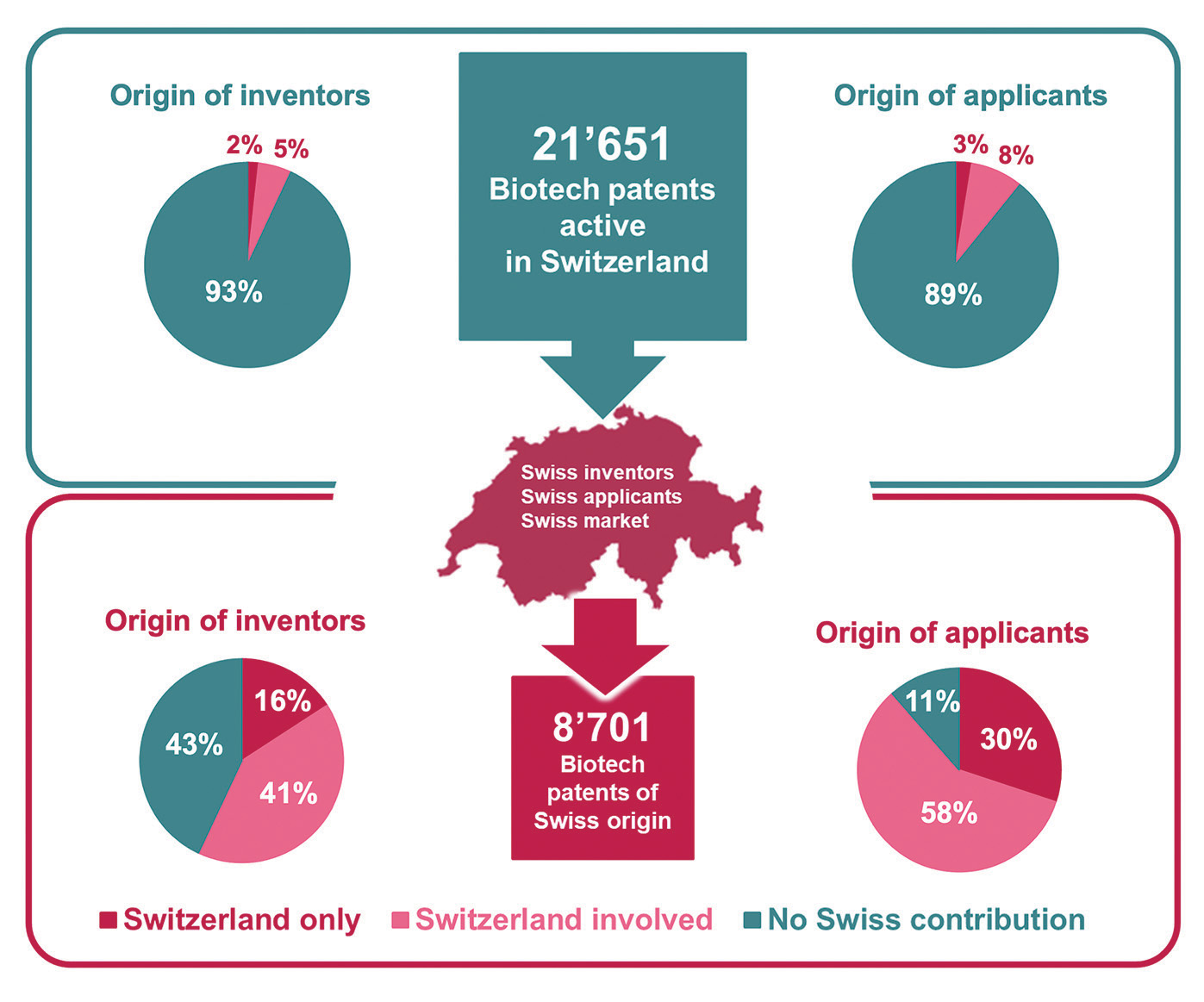

A total of 21’651 biotech patent families are currently active in Switzerland, i.e., granted and in force. This is 2.5 times the number of 8’701 active biotech patents of Swiss origin, invented or owned by a Swiss resident. The vast majority, 88% of the patents active in Switzerland are not of Swiss origin, neither invented nor owned by residents of Switzerland. The 8’701 patents of Swiss origin comprise about 5’000 patents naming inventors resident in Switzerland, and 7’700 patents filed by applicants from Switzerland, with considerable overlap. In fact, most of the patents list several inventors and applicants, often from different countries, thereby resulting in significant overlaps in all analyses presented in this article.

Purely Swiss patents, with both inventors and applicants exclusively from Switzerland, account for only 11% of the patents of Swiss origin. The majority of the portfolio involves co-inventors and/or co-applicants from outside Switzerland, emphasizing the strong international links of both the Swiss industry and the Swiss academic research community. Notably, more than 40% of the patents of Swiss origin do not list any Swiss inventors, but they have been filed by a Swiss applicant.

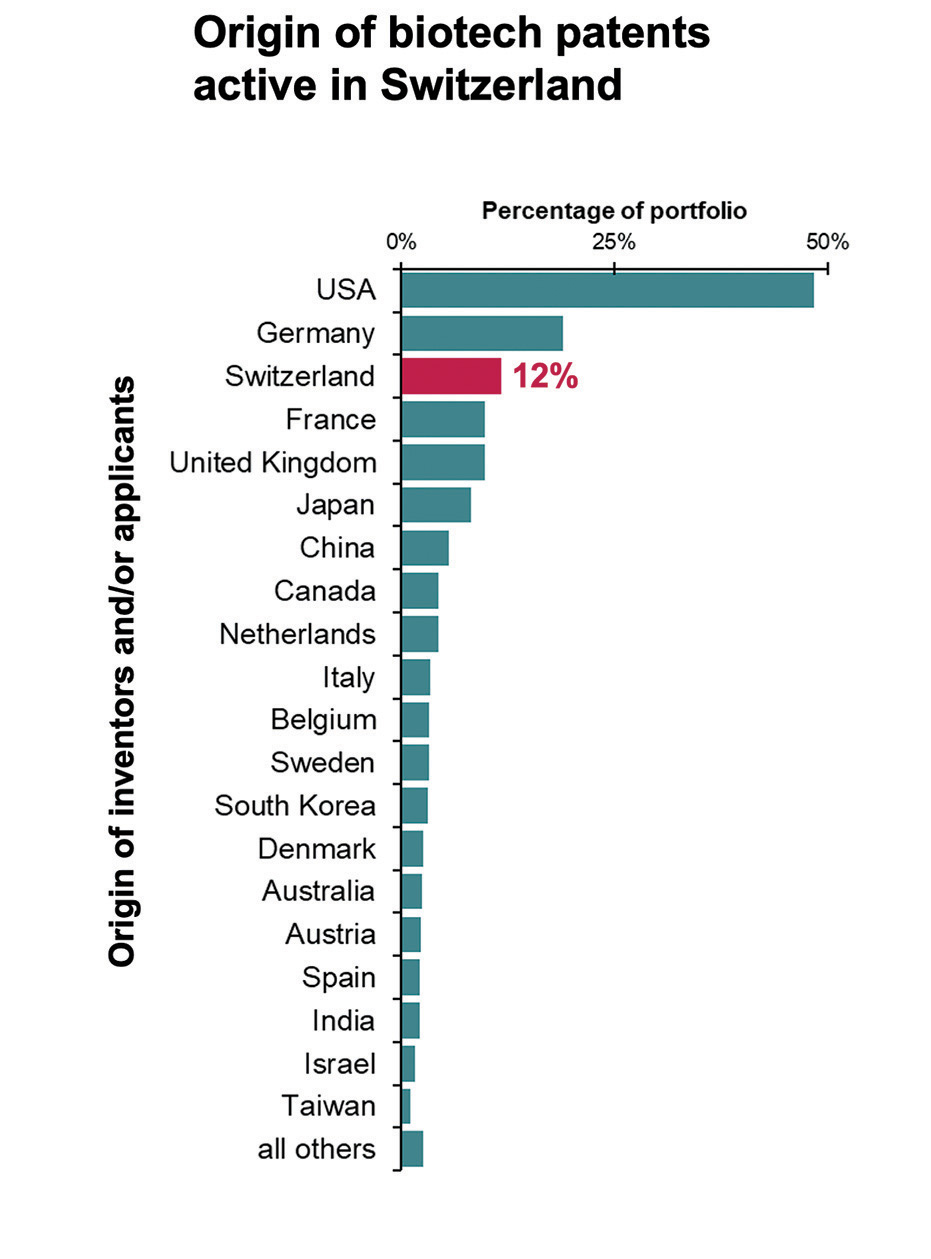

Origin of biotech patents active in Switzerland

The 21’651 biotech patents active in Switzerland include all patents granted and in force in Switzerland. This does not include the 78’000 currently pending international applications in the biotech sector, filed under the Patent Cooperation Treaty (PCT) or the European Patent Convention (EPC). These pending applications were excluded here, because they would inflate the numbers across the board and mask the differences between the countries. At this point in time, it remains unclear how many of these pending applications will be validated in Switzerland sometime in the future.

The USA is the dominant origin of patents active in Switzerland, both in terms of inventors and applicants, followed by Germany and France. The top five countries of origin, including Switzerland, account for two-thirds of all patents active in Switzerland.

Patents of Swiss origin account for 12% of the patents currently active in Switzerland.

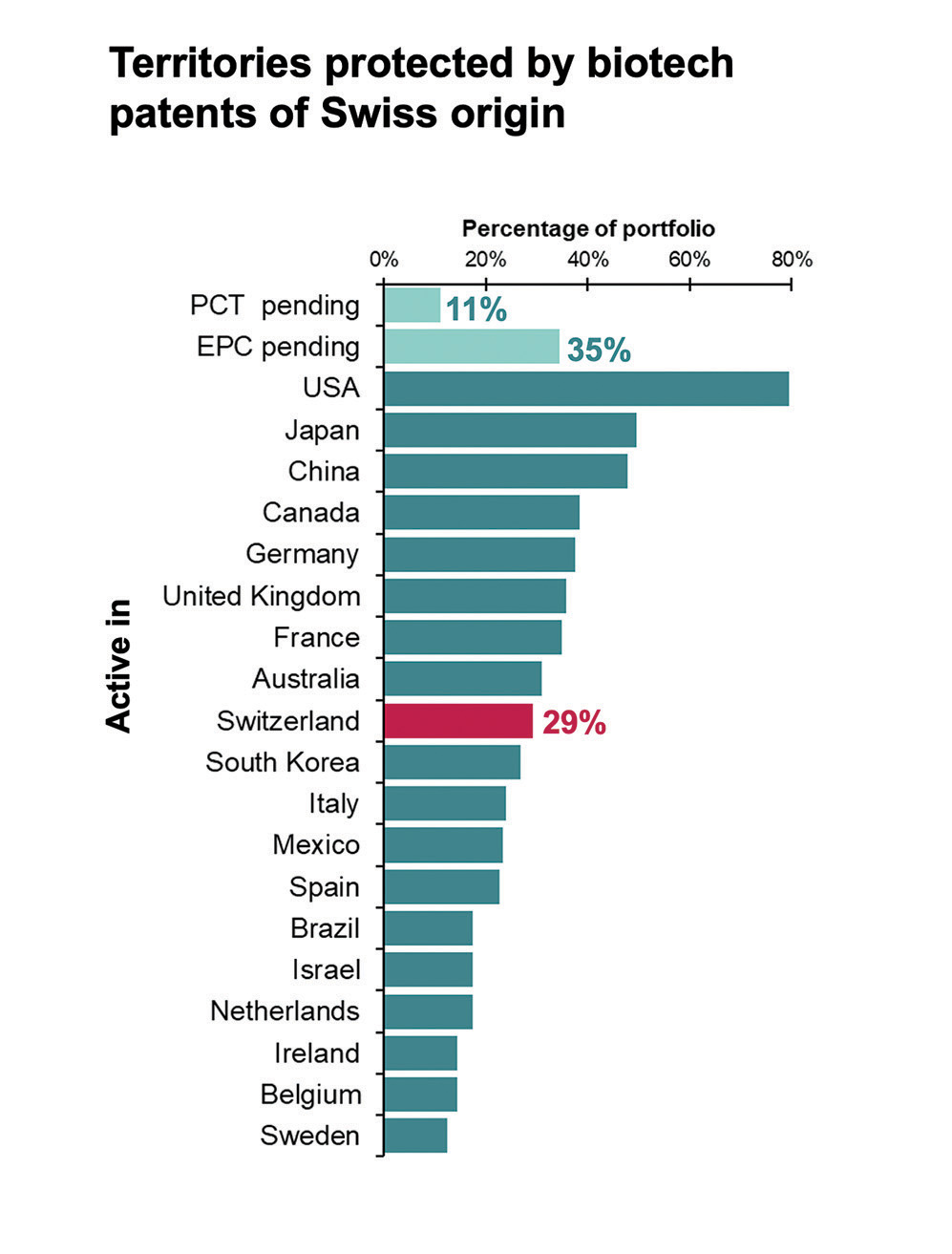

Territories protected by biotech patents of Swiss origin

The 8’701 biotech patents of Swiss origin, i.e., those assigned to a Swiss inventor or applicant, are active in many countries around the world. In contrast to the previous section, this portfolio does also include the pending international applications filed under PCT or EPC.

Almost 80% of the patents of Swiss origin are active in the United States, and half of them are also validated in Japan and China.

Only 29% of patents of Swiss origin are currently in force in Switzerland. However, the pending international applications (PCT or EPC), accounting for 46% of the portfolio, still have the potential for validation in Switzerland, or any other European country.

For the non-European states, this additional coverage is limited to the 11% pending PCT applications.

A full third of the patents of Swiss origin are definitely not targeting the Swiss market. Over 80% of these patents are active in the United States.

Patent density: the global view

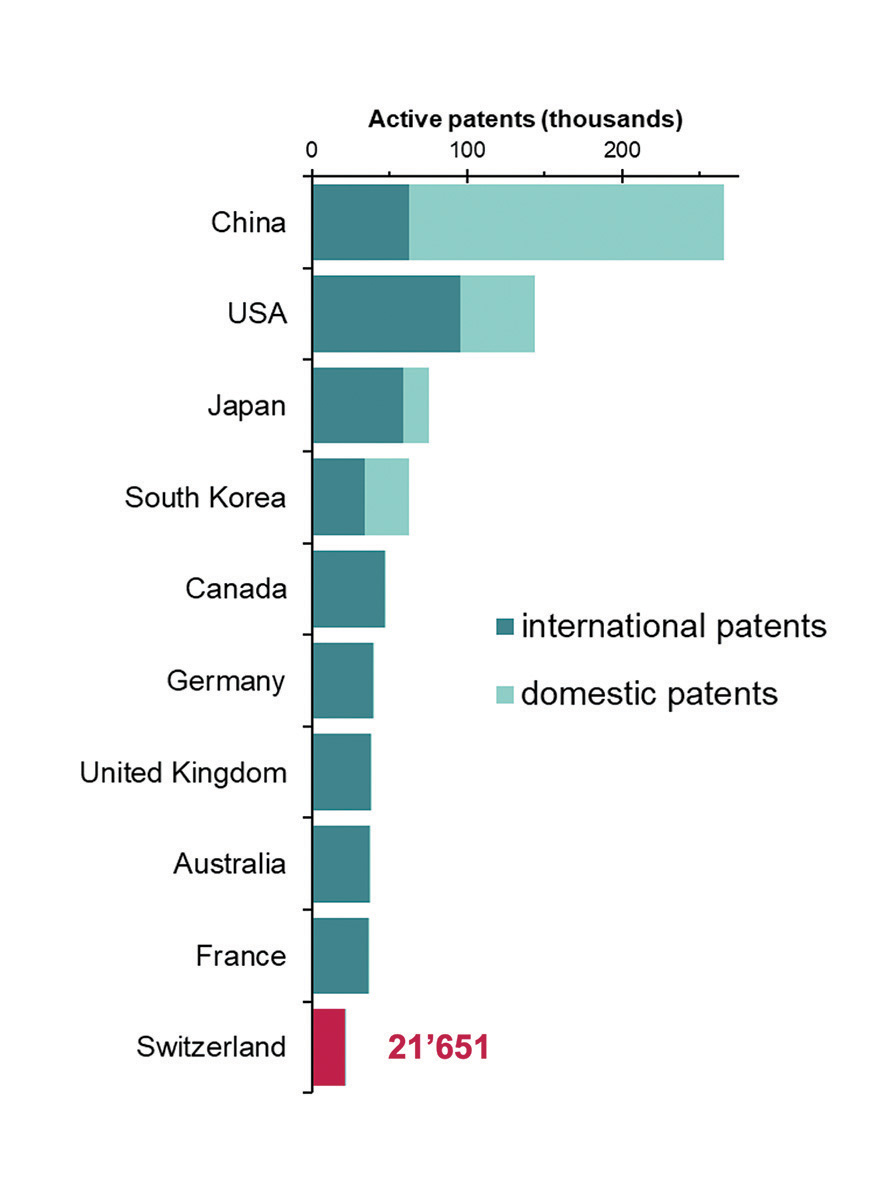

Active patents per country include all patents that are pending or in force in a given country, also known as patent density. Figure 4 shows the ten countries with the highest number of active biotech patents in their territory. Again, the 78’000 pending international applications under PCT or EPC are excluded to avoid masking differences between countries.

China has the highest number of active biotech patents in its territory. Nearly 60% of the currently 450’000 active biotech patents worldwide are active in China, followed by the United States (32%), Japan (17%), and South Korea (14%).

The active patents in the top four countries include a significant proportion of domestic patents filed only in the respective country concerned, and with no effect in any other country. In China, 76% of all active patents are domestic. Taken together, two thirds of the biotech patents worldwide are domestic patents, and active in a single country only.

In contrast, the countries on ranks five to ten have hardly any domestic patents.

Switzerland ranks 10th and is still within the top ten countries worldwide, even though Switzerland represents a much smaller market than the top nine economies.

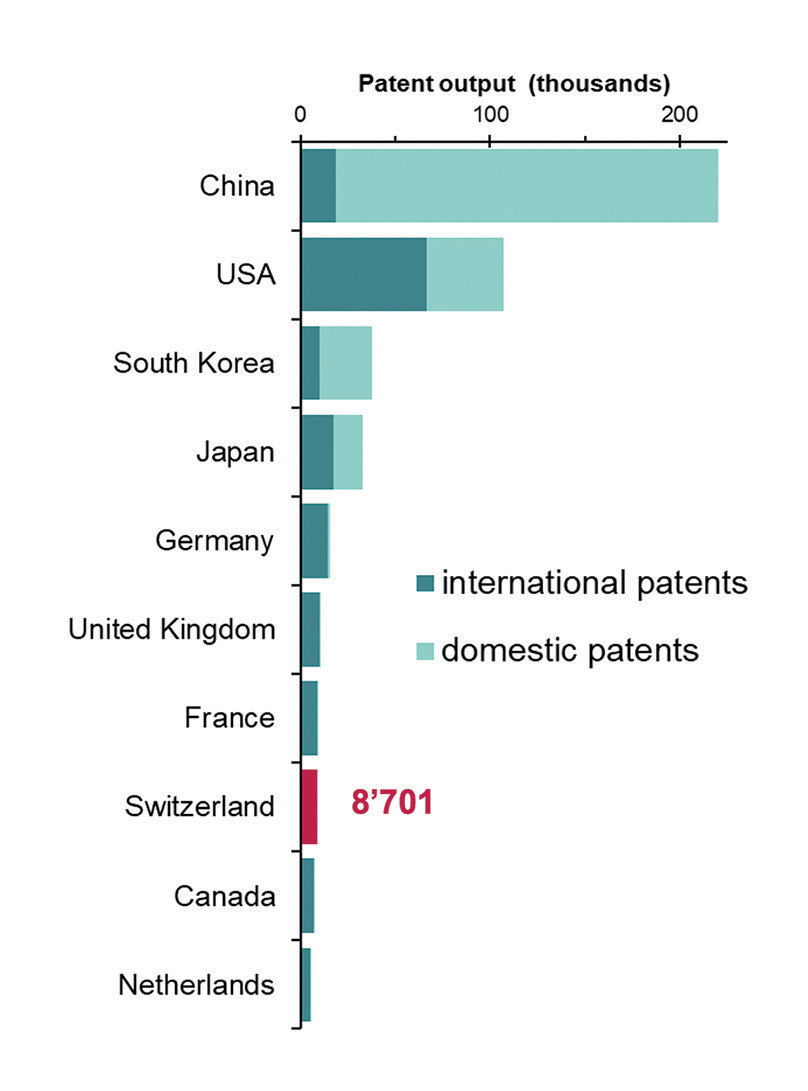

Patent output: the global view

The patent output of a given country of origin is defined as the sum of all patents either assigned to an applicant from that country or invented by a resident of that country. Currently, approximately 450’000 biotech patents are active worldwide, including all pending international applications.

China and the United States also dominate in terms of biotech patent output, followed by South Korea and Japan. These top four countries together account for almost 90% of all active biotech patents. The same four countries also have a significant proportion of domestic patents, active only in their own territory. More than 90% of the patents originating from China are domestic patents, as are 38% of the patents originating from the US.

In contrast, the six next ranked countries generate very few domestic patents. Almost all biotech patents of European origin are filed as PCT or EPC applications and thus, are international patents.

Conclusions

Biotechnology inventions provide solutions to global problems and address global markets. Accordingly, one would expect biotech patents to be filed and validated in multiple countries.

However, it turns out that this is only true for one third of the biotech patents worldwide. Two thirds are validated exclusively in a single country, in one of the home markets of the four dominant countries of origin; these are China and the US, followed by Japan and South Korea. This dominance applies not only in terms of innovation, as measured by patent output. It is equally evident from a market perspective, as reflected in the number of patents active in each country.

Despite its small size, Switzerland ranks among the top ten countries in terms of both the output of patents and patent density. However, it should be emphasized that biotech inventions of Swiss origin are mainly the result of international collaboration, as discussed in the 2023 edition of the Swiss Biotech Report.

In general, three main reasons motivate patent owners to validate a patent in a particular country:

- protection of the home market by the patent holder resident in that country

- the country is an attractive market worth protecting

- serious competitors are located in the country

Obviously, the Swiss territory is worth protecting for patent owners from all over the world. This is because Switzerland is an important source of biotech inventions and is home to key players in the global biotech industry.

In terms of patent output, Switzerland ranks eighth in the world. Notably, domestic patents account for less than 0.2% of the portfolio of Swiss origin.

Methodology and definitions

Biotechnology patents were identified according to the World Intellectual Property Organization (WIPO) technology field definition, based on patent classifications.

The term patents in this article refers to active patent families. Active patent families are defined as patent families with at least one family member granted and in force, or pending at a given time point. For the data presented here, this time point is 7 December, 2023.

A patent family includes all patents worldwide that are based upon the same common technological content, referring to the same original priority application.

International applications are patents filed under the Patent Cooperation Treaty (PCT) or under the European Patent Convention (EPC). PCT applications are administered by the WIPO, EPC applications by the European Patent Office (EPO).

A portfolio refers to a collection of patents, for example all biotech patents active in Switzerland.

The data was generated by PatentSight, a commercial patent database and analysis software.