- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Monday, May 5, 2025 @ 11:00 am

Despite many biotech companies continuing to face financing challenges in 2024, some Swiss companies performed well and positively influenced the key industry metrics. Overall capital investments in the Swiss biotech industry were CHF 2.5 billion in 2024, an increase of 22% compared to the previous year, but this was shared between a relatively small number of companies. Private biotech companies performed particularly well, with new record levels of financing (CHF 833 million), record levels of R&D expenses (CHF 1.4 billion) and total revenues of CHF 2 billion, an increase of 10% compared to 2023 levels.

Frederik Schmachtenberg

EY | Partner, Global Life Sciences Lead for Financial Accounting Advisory Services

Helena Rosa

EY | Director, Global Health Sciences & Wellness, Audit Services

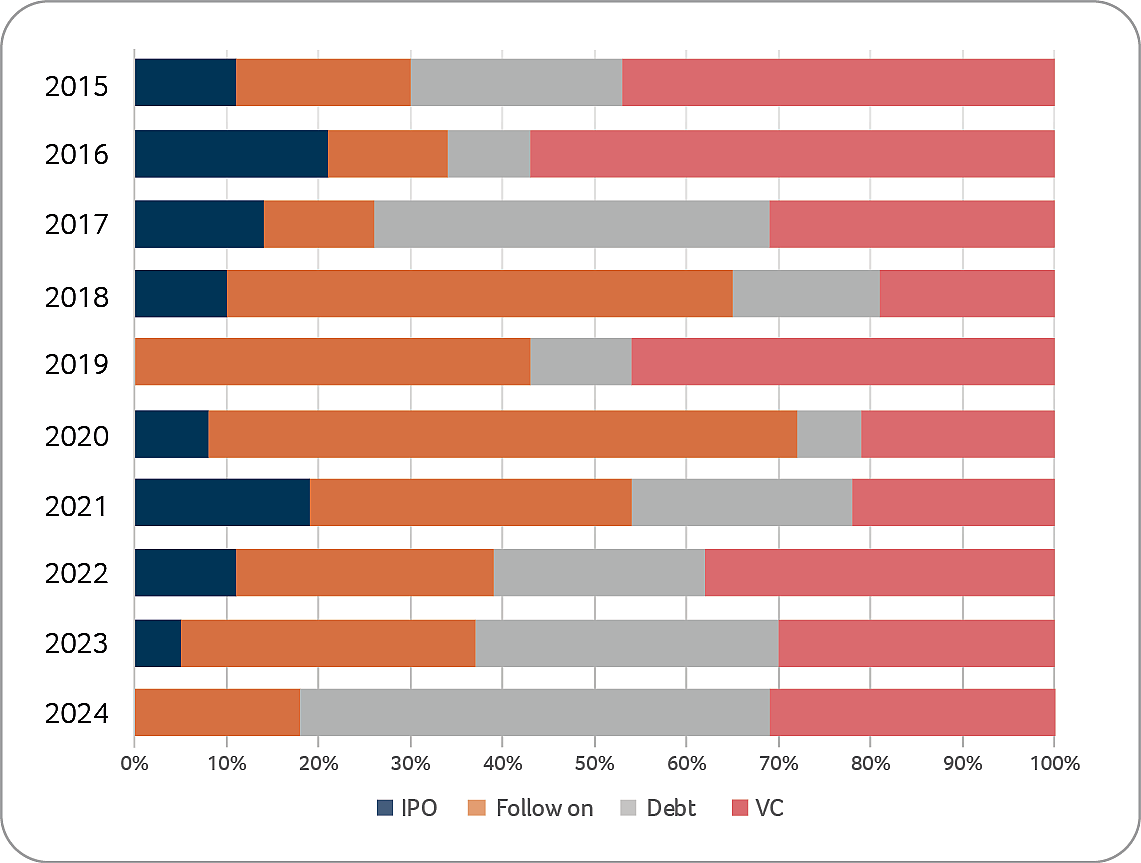

As in 2023, in some respects 2024 continued to be a difficult year for the biotech sector overall, mainly due to ongoing challenges in the financing environment of public capital markets. Despite these circumstances, many Swiss biotech companies developed strongly. Globally there were 30 IPOs in 2024 (2023: 18), generating approximately USD 4.0 billion in funds (2023: USD 2.9 billion), with 26 of the IPOs occurring in the US. There were four biotech IPOs in Europe (compared to two in 2023) but the funds raised by these four IPOs was USD 106 million (USD 0.3 billion in 2023). In Switzerland there was only one capital market transaction in 2024, through a reverse merger transaction (Curatis) in April 2024.

Swiss biotech landscape

In 2024, the Swiss biotech industry overall saw a slight decrease in revenues recognized (CHF 7.2 billion in 2024 compared to the record level of CHF 7.3 billion in 2023), whereas R&D investments slightly increased (CHF 2.6 billion in 2024 compared to CHF 2.4 billion in 2023). Consistent with the increase in R&D expenses, the number of FTEs working in Swiss R&D biotech companies also increased compared to 2023, which seems to be an indicator that even when some companies had to restructure or reorganize, the highly qualified employees often quickly find new opportunities with other companies in the biotech sector. However, the increase in FTEs should also be seen in the context of Swiss CDMOs’ increased relevance. As CDMO activity today includes more and more complex molecular structures, combined with increased GMP regulations, the specialized R&D and production knowhow of Swiss CDMO has seen a significantly uptick in demand. Also, looking at the performance of public and private biotech companies separately, it is impressive how well private biotech companies performed in 2024, with record levels of financing (CHF 833 million), record levels of R&D expenses (CHF 1.4 billion) and total revenues of CHF 2 billion, an increase of 10% compared to 2023 levels.

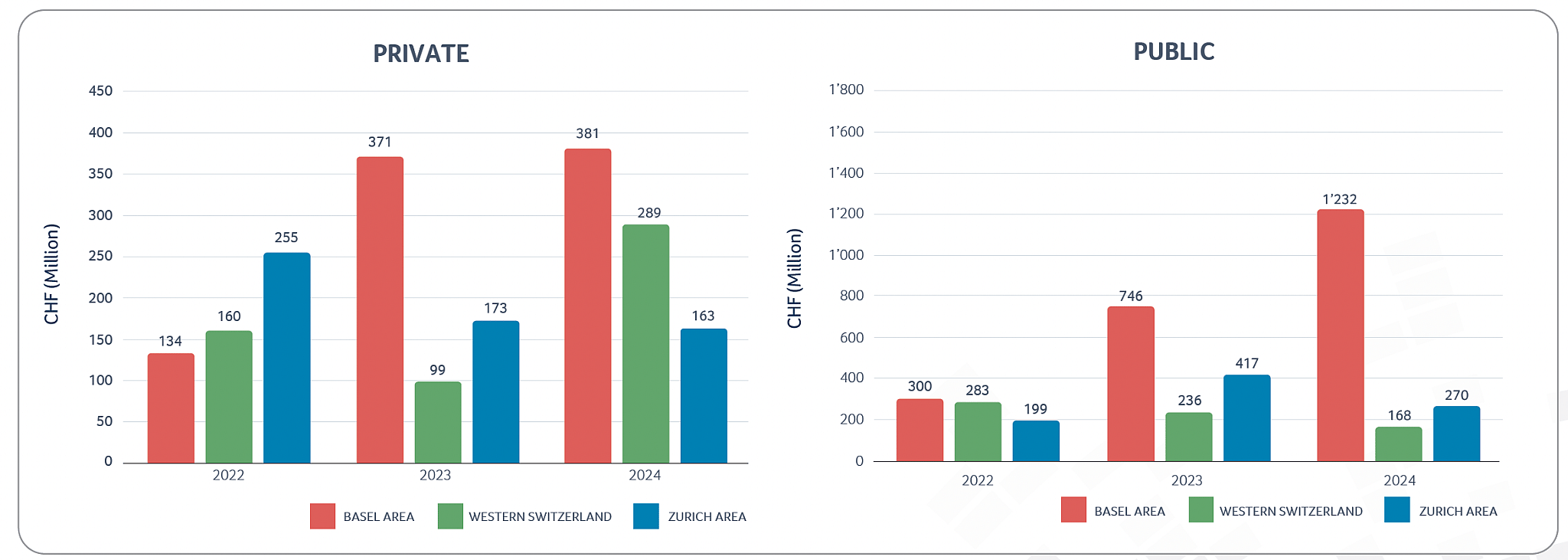

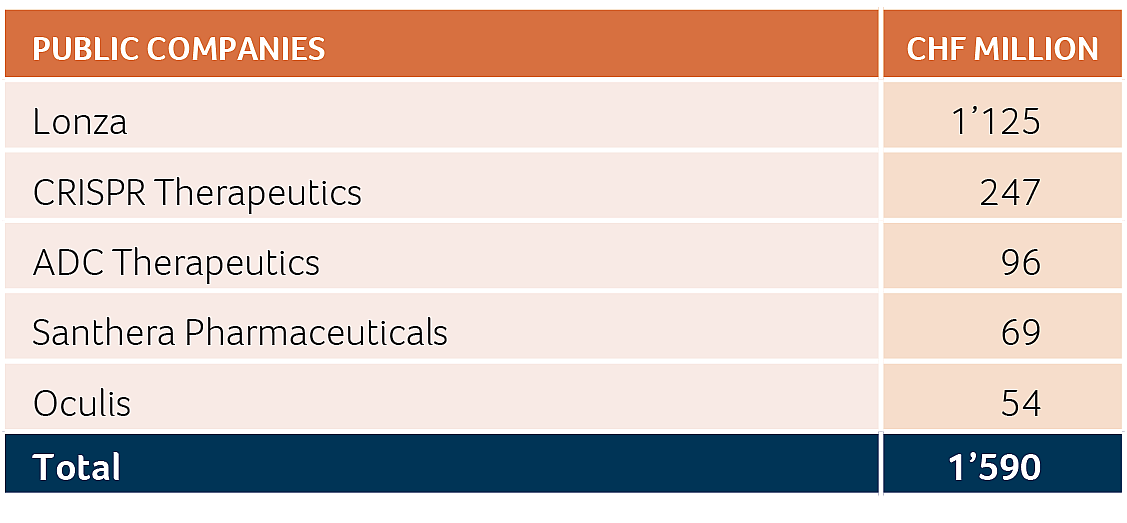

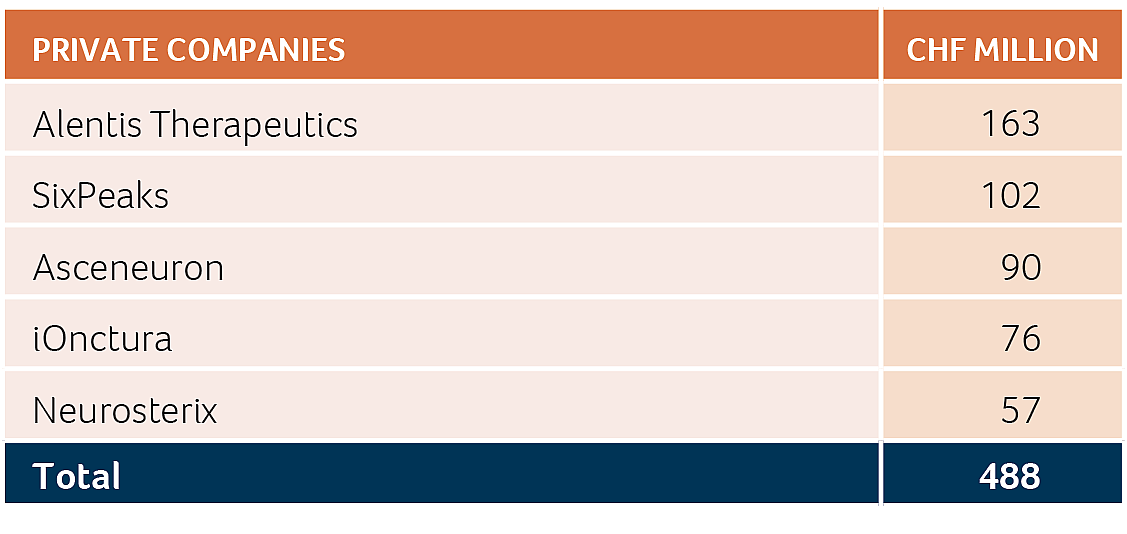

In terms of overall financing, the Swiss biotech industry raised more than CHF 2.5 billion in 2024 (2023: CHF 2.0 billion), an increase by more than 22% in capital investments, with around CHF 1.7 billion collected by public companies and the remaining CHF 0.8 billion collected by private companies. Alentis Therapeutics (with CHF 163 million raised) and SixPeaks Bio (with CHF 102 million raised) were the two largest private company financing transactions in 2024, contributing to the new record level of financing for the private Swiss biotech companies mentioned above.

As noted, given the overall difficult capital market environment, there was no Swiss listing activity in 2024 other than the Curatis reverse merger into Kinarus Therapeutics Holding on SIX Swiss Exchange, announced in January 2024 and successfully completed in April 2024. Further, CRISPR Therapeutics, a Swiss biotech that went public in 2016, in 2024 secured a USD 280 million (CHF 247 million) follow-on financing, to finance its on-going clinical trials in oncology, cardiovascular and diabetes and further accelerate its auto-immune and in vivo gene writing programs.

However, 2024 was still a difficult year for several publicly listed companies, which resulted in the initiation of some restructuring measures or, even worse, the going concern assumption was in question due to setbacks in clinical studies or insufficient funding. Selling of valuable assets (Evolva, Spexis), entering a reverse merger transaction (Kinarus), or even taking the decision to stop operations (ObsEva) were some of the unfortunate implications. However, also in the circle of public biotech companies, there were several companies that were able to navigate the, in some respects, difficult environment well and were able to hit significant development or product approval milestones in 2024 (e.g., Basilea, Santhera).

In summary, while total capital investments in 2024 increased by more than 22% compared to 2023, relatively few companies benefited; in other words, many companies unfortunately received little or no funding. This is also evidenced by the fact that the total financing of the Top 5 financing transactions in 2024 increased by 80% for public biotech companies and by 30% for private biotech companies, compared to 2023; a trend that started in 2023 and which continued in 2024.

In addition, or one could say as a result, with equity and debt markets still being more difficult to access for many companies, Swiss biotech companies continued to be agile in terms of finding alternative ways of financing (licensing, collaborations, but also monetization of assets transactions) which, in a similar way to 2023, provide significant non-dilutive financing also in 2024.

M&A and collaborations

Swiss companies were involved in several significant M&A transactions:

- Lonza signed an agreement to acquire the large-scale biologics site in Vacaville (US) from Roche

- The business combination of Kinarus Therapeutics Holding (now renamed to Curatis Holding) and Curatis, with the first trading day of the Curatis Group shares (CURN.SW) on SIX in April 2024

- Johnson & Johnson acquired Yellow Jersey Therapeutics, a demerged subsidiary of Numab for USD 1.25 billion in May 2024

At the same time, entering into new collaboration and licensing agreements was important for several Swiss biotech companies as some of those partnerships contained significant attractive financial components, which – as mentioned above – provided alternative ways of funding (alternatives to equity or debt financings, which continued to be more difficult to obtain in 2024). A selection of such collaboration and licensing transactions is shown below:

- NewBiologix signed a licensing agreement with Florabio to genetically engineer their proprietary HEK293 cell line for recombinant adeno-associated virus (rAAV) vectors

- Idorsia and Viatris entered into global R&D collaboration, with an upfront payment of USD 350 million and potential development and regulatory milestone payments, additional sales milestone payments, and tiered royalties on annual net sales

- Addex and Perceptive launch Neurosterix, a company focused on developing allosteric modulators with USD 63 million of initial funding

- MoonLake Immunotherapeutics entered into a three-year technology partnership with Komodo Health to advance research on inflammatory skin and joint conditions

- BioVersys announced an expansion of the strategic collaboration with GSK and an extension of its Series C by CHF 12.3 million

- AC Immune and Takeda signed an exclusive option and license agreement for active immunotherapy targeting Amyloid Beta for Alzheimer’s disease, receiving USD 100 million as an upfront payment, with the further possibility to receive USD 2.1 billion

- Topadur Pharma and Oshen Holdings signed a CHF 15 million agreement to co-develop and commercialize TOP-M119 for treating alopecia in Greater China

- Valneva and LimmaTech entered into a strategic partnership to accelerate the development of the world’s most clinically advanced tetravalent Shigella vaccine candidate

- HAYA Therapeutics entered into a collaboration with Lilly to discover novel Regulatory Genome Targets for obesity and related metabolic conditions using proprietary RNA platform and is eligible to receive up to an aggregate USD 1 billion in milestone payments

- Numab Therapeutics and Kaken Pharmaceutical entered into a collaboration and option agreement for multi-specific antibody ND081 for treatment of inflammatory bowel disease, with Numab receiving a CHF 13 million upfront payment

- Basilea announced signing of an agreement with Innoviva Specialty Therapeutics for the commercialization of antibiotic Zevtera® (ceftobiprole) in the United States, receiving USD 4 million upfront and additional potential USD 223 million to be received at a later stage

Product developments

In 2024, the industry saw an increased number of regulatory approvals, which is very positive. More specifically, the EMA approved 114 new drugs in 2024 (2023: 77 new drugs) although there was a slight decrease in FDA approvals, with 50 new drugs approved (compared to 55 in 2023).

Furthermore, among the new FDA approvals there was one new drug developed by Octapharma, which received approval for fibryga to treat acquired fibrinogen deficiency, as well as Basilea’s FDA approval of antibiotic Zevtera® (ceftobiprole medocaril) for three indications. Besides the increased number of approvals, it is also positive to note that Santhera’s AGAMREE® obtained approval in China and in Hong Kong during 2024.

In terms of new product approvals in Switzerland (approvals by Swissmedic), a similar trend could be observed. In 2024 54 applications for new product approvals were received by Swissmedic, of which 46 were approved (2023: 49 applications, of which 41 were approved).

Awards

Several Swiss biotech companies also received various prestigious awards throughout 2024. Some of these awards included:

- SOPHiA GENETICS named in “Built In’s Esteemed 2024 Best Places to Work” awards

- Idorsia’s novel treatment for chronic insomnia won the prestigious Prix Galien Suisse 2024 innovation award in the ‘Primary & Speciality’ category

- Andreas & Thomas Strüngmann award recognized HAYA CEO Samir Ounzain and CTO Daniel Blessing for their entrepreneurial vision in life sciences in the DACH region

Private & public Swiss biotech regional financing 2022-2024