- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Tuesday, April 21, 2020 @ 10:00 am

A look into the past, present and future of the SXI Bio+Medtech Index indicated it has been outperforming its benchmarks in the last five years to January 2020.

Fabian Gerber

SIX | Senior Relationship Manager Primary Markets

SIX is one of the leading biotech/life sciences stock exchanges and home to the most highly capitalized biotech companies in Europe. To reflect the high importance of this sector, a special index - the Swiss Bio+Medtech Index (SXI) - was created in 2004. The index increases the visibility of companies in this sector and meets the needs of investors who wish to participate in this attractive segment.

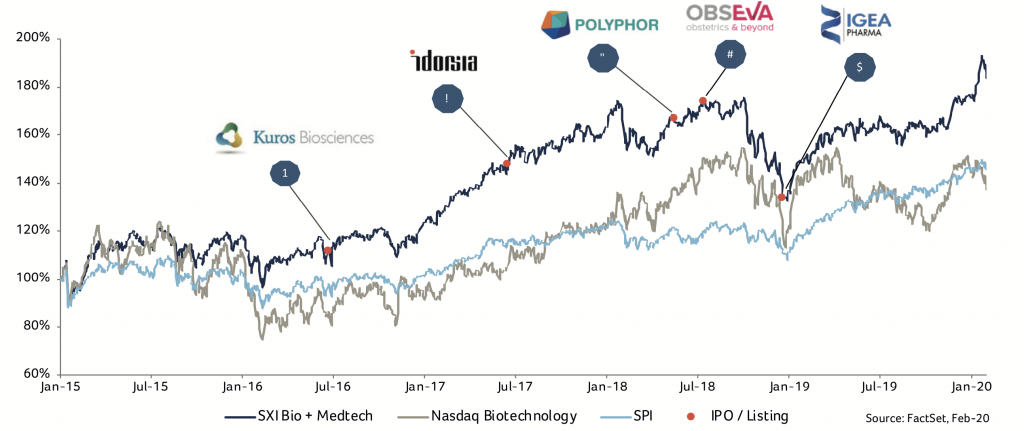

Figure 1: SXI Bio+Medtech Index Jan 2015 to Jan 2020

“Over the past five years to end Jan 2020, the SXI Bio+Medtech Index has clearly outperformed both the Swiss Performance Index (SPI) by 38% and the NASDAQ Biotechnology Index by 46%. This impressive development underlines the high quality of the listed biotech companies on SIX as well as the great interest of a large Swiss and international investor base.“

To be included in the index, a company requires a primary listing on the Swiss Stock Exchange with a minimum free-float market capitalization of at least CHF 100 million. The weighting of individual stocks on the index is limited to 10%, whereby small- and medium-sized enterprises are gaining in importance. The index currently comprises 19 companies.

Latest SIX inclusions

Of the biotech listings in the last five years, Idorsia (16 June 2017), Polyphor (15 May 2018) and Obseva (13 July 2018) have made it into the index. Polyphor's IPO was one of the largest European biotech IPOs in recent years in terms of proceeds raised, enabling the company to raise CHF 155 million to finance the development of its pipeline.

Obseva, on the other hand, undertook a dual primary listing on SIX, after its U.S. listing, to further strengthen its profile among Swiss and European investors. This strategy provides Obseva with an additional robust market for future potential financing activities and allows it to protect its shareholders through Swiss takeover rules.

Idorsia’s stock price has risen considerably since its market debut on SIX, whereas a different picture emerges in the case of Polyphor and Obseva. Both securities have been subject to major fluctuations in value since their respective IPOs, each supported by trading volumes significantly above their annual average volume at the respective points in time.

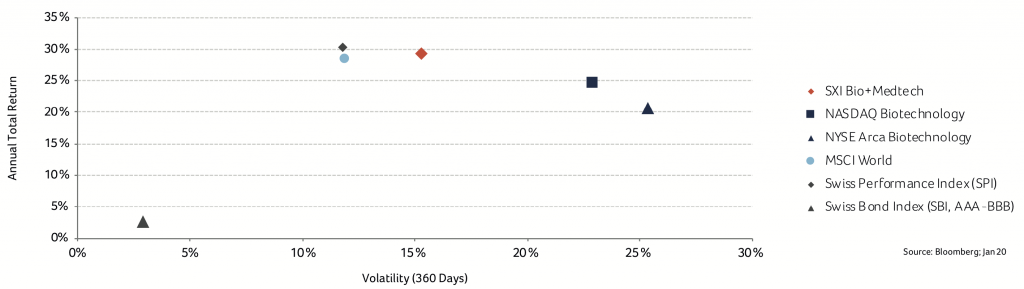

Figure 2: 2019 Indices volatility and returns

The rewards of volatility

It is generally known that biotech stocks are subject to specific risks and thus susceptible to larger volatility of returns, both upward and downward. These include regulatory setbacks, clinical failure, commercialization challenges such as market access, and patent expiration.

However, the risk-return chart (see Figure 2) - with selected indices for the year 2019 - shows that in the case of the SXI Bio+Medtech Index, investors have nonetheless been adequately compensated for higher risks taken. Compared to the NYSE Arca Biotechnology and NASDAQ Biotechnology Index, the risk-return profile is even highly attractive.

The X-axis reflects volatility and the Y-axis, yield achieved. The further a company positioned to the upper left on the index chart, the better its risk/return profile. 2019 was an excellent year for equity securities with the SPI reaching new record levels. Biotech stocks also benefited from this general upward trend, achieving about the same returns but showing a slightly higher volatility.

Consider a longer time horizon however, and the SXI Bio+Medtech succeeds in outperforming all benchmarks listed in the chart. This is also reflected in the Sharpe Ratio - also known as the Reward to Volatility Ratio - which has established itself as a widely used and recognized method of calculating risk-adjusted returns. With a 5-year Sharpe Ratio of 0.70% , the SXI Bio+Medtech Index lies above the SPI (0.57%) and even further above the other indices.

Investment opportunities on SIX

On SIX, investors can invest in the biotech sector either directly - in single stocks of listed biotech companies or the listed biotech investment companies - or through other listed products. For example, investors can participate in the performance of the SXI Bio+Medtech with a tracker certificate (ISIN CH0020040397). SIX also offers trading in two Exchange Traded Funds (ETFs) and six investment funds, which are specifically dedicated to the biotech sector.

By the end of January 2020, assets in investment funds amounted to around CHF 6 billion, which is well above those of the ETFs on SIX. Even taking into account that these ETFs have not existed as long as investment funds, it seems clear, contrary to the general trend towards passively managed investments, that when it comes to the biotech sector, investors in Switzerland seem to prefer actively managed solutions.

Various promising pieces of news in the first weeks of 2020 have led to the SXI Bio+Medtech index gaining 5% as of 31 January 2020, with several biotech stocks being among the best performing stocks in the SPI. Nevertheless, in the future volatility will remain higher than in other sectors, not least because of investors' high expectations.

Innovations from SIX

In 2016, SIX launched the “Stage Program” to support listed companies in expanding their market presence and visibility among key stakeholders. The aim was to reduce uncertainty (and hence volatility) and better manage investors’ expectations.

With this program SIX supports companies in the process of building their presence in the market and achieving appropriate valuation through research coverage. Two listed biotech companies - Addex Therapeutics and Newron Pharmaceuticals - are currently participating in the program and more are to follow.

Note: None of the information contained herein constitutes an offer or a recommendation to buy or sell or take any other action regarding financial instruments. SIX Group Ltd or its direct and indirect subsidiaries (hereafter: SIX) are liable neither for the completeness, accuracy, currentness and continuous availability of the information given, nor for any loss incurred as a result of action taken on the basis of information provided in this or any other SIX publication. SIX expressly reserves the right to alter prices or composition of products or services at any time. © SIX Group Ltd, 2020. All rights reserved.