- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Thursday, May 3, 2018 @ 12:00 am

Some 40 years ago, in 1978, one of the world’s oldest biotech companies, Biogen, was founded in Geneva, Switzerland. Twenty years later there was a coming of age when representatives from the Swiss biotech industry gave the young industry a voice with the formation of the Swiss Biotech Association (SBA). We look back at the challenges met on the industry’s path to maturity and look forward to the key trends in its further evolution.

Swiss biotech is a growing and competitive industry. The huge investments made into the construction of mammalian cell biotech production facilities is particularly remarkable: Key companies include American Biogen, Australian CSL Behring, Belgian UCB, as well as Swiss Lonza and Roche, a pharma company with the world’s largest embedded biotech product portfolio.

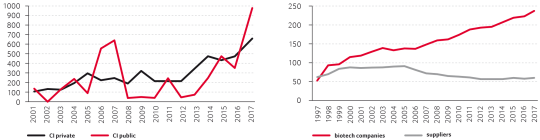

Companies and suppliers in the health biotech sector have shown consistent development over the last 20 years. Today this is one of the strongest segments of biotech activity in Switzerland. This growth has occurred despite sometimes challenging access to private investment or venture capital and very volatile public investment from IPOs (initial public offerings) and stock exchanges.

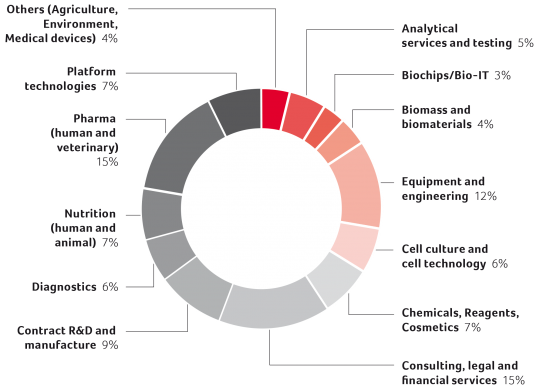

Over the time some companies discontinued operations, others were removed from the biotech statistics as they moved their headquarters outside of Switzerland or were reclassified as pharma due to mergers or acquisitions. Apart from health biotech, featured in the Swiss Biotech Report over the years, it is difficult to quantify Switzerland’s industry in other biotech sectors such as industrial biotech or agricultural biotech. Having said that, if we analyze the data from the SBA directories since 2007 we see very little change. The chart on page 7 shows distribution of activities of the listed Swiss biotech companies (multiple entries possible).

Evolutionary challenges

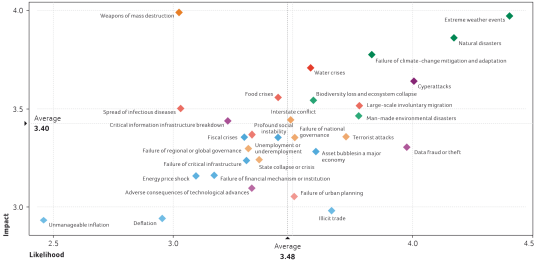

Many organizations – including the European Parliament and the Swiss National Science Foundation (SNSF) – constantly screen and identify trends, challenges and risks. The annual World Economic Forum’s (WEF) Global Risks Landscape (page 6) presents most of the challenges or trends mentioned by other organizations. Will biotechnology play a role in addressing some of these challenges and risks? Or are biotech stakeholders merely subject to these risks and therefore having to cope simply with their consequences?

WEF’s Global Risk Report identifies biotechnology as technology with above average benefits. It seems that biotechnology could be part of the solution addressing risks such as population ageing and health risks (chronic diseases, pandemics, spread of infectious diseases). At the same time it is also viewed as a technology with above average negative consequences that could worsen environmental and geopolitical risks, and one that needs more governance.

Addressing challenges

Society has multiple options to deal with challenges and risks deriving from the analysis of trends:

- Ignore the findings;

- Ban technologies;

- Develop roadmaps or strategies to address challenges;

- Invest in research; or

- Install regulations and governance instruments.

Switzerland has used some of these strategies to make best possible use of the benefits of biotechnology to cope with global risks as well as address the risks around biotechnology itself.

Technology bans: In 2005 Switzerland installed a moratorium (until 2021) on the cultivation of Genetically Modified Organisms (GMOs) in agriculture, silviculture or horticulture. Public research is funded so that Swiss universities can maintain their scientific standing and to study the risks of the technology. The ban hampers development of a Swiss agricultural biotech industry while the rest of the world has raced ahead, sometimes in unstable and non-governed states.

Road maps: In contrast to Europe and the USA, Switzerland has no biobased economy roadmap. This may be due to the country’s limited supply of biobased raw materials or because the Swiss industrial biotech market is not perceived as relevant enough. The activities of Swiss chemical and pharmaceutical industry in biocatalysis to replace chemical processes in highvalue products should not be underestimated. One can only guess what the sector could achieve with the support of a roadmap.

National strategies and policies: Relevant Swiss strategies and policies are the National Rare Disease Policy (passed in 2014) and the Swiss Antibiotic Resistance Strategy (StAR, adopted in 2015). Both tackle important issues but neither address research to (clinically) develop innovative medicines. This is regrettable given the potential of the Swiss biotech industry to provide leverage. The value creation potential of Swiss biotech industry is under-appreciated: it could serve the local market and be a global player spreading Swiss-based standards to counter global threats.

Investing in research: Overall research investments in Switzerland amount to roughly 3% of the Swiss GDP. Two thirds are invested by Swiss industry with at least 8.6% spent within biotech research (bfs.ch 2004 data). Only about 25% is financed by public funding (e.g. SNSF or Innosuisse), mostly bottom-up research. For the rest, these Swiss institutions are continuously aligning funding with research areas that are perceived as important. However, to maintain or increase the huge commitment of Swiss industry to fund research in Switzerland the implementation of supporting framework conditions is key.

Legislation and regulations: The Federal Act on Research involving Human Beings (Human Research Act, HRA) governs Swiss biotech research in industry and academia. The 2015 annual report from all Swiss Ethics Committees reported that of some 585 clinical trial applications, only 210 were on novel and not yet approved medicinal products (category C). Given that selected members of SBA members alone develop some 180 compounds (SBA members’ product pipeline, February 2018), this leads to the conclusion that Swiss companies largely conduct clinical research on innovative medicines outside of Switzerland.

Conclusions and current developments

Regulating a global industry: From a Swiss or European point of view, the perception of risk in biotechnology seems inadequate. The potential for negative consequences is continuously discussed and the likelihood decreased through regulatory frameworks. Because Swiss legislation does not influence the situation in non-regulated or instable states, it seems to make sense for the Swiss regulatory framework conditions to be designed to increase research and manufacture in Switzerland. When biotech manufacture and research activities remain and are strengthened in Switzerland, then Swiss legislation will have indirect international outreach through the global exports.

New players in drug development: Increasingly we find that academia is initiating early clinical trials financed by public research funding, because the pharmaceutical industry mainly inlicenses late-stage drug projects. As the next step towards translational medicine, academia will either have to build up GLP (Good Laboratory Practice), GCP (Good Clinical Practice) and GMP (Good Manufacturing Practice) competences or outsource. 7 In addition, nonprofit organizations within civil society receive public funding or donations to develop and produce medicine for under-served populations or against neglected or rare diseases. These organizations generally have direct access to patients, but typically do not have the competences and infrastructure to safely produce their products for global markets.

Where there is a specific area of national interest in pharmaceuticals – such as in the development of antibacterials or antivirals – some nations are actively involved in drug development or finance programs in industry. Due to global agreements on restricted use and the lack of financial models to compensate for the development of such emergency drugs, it seems that society or governments are best suited to finance the development of these medicines.

These market failures in drug development and the lack of new business models, means that increasing numbers of organizations from civil society, academia and government are taking an active role in the development of drugs using either money from the public purse (tax money) or donations from private persons.

Next generation of technology companies: Investment in basic research results in new technologies that are patented and after some years of further development transferred into (Swiss) industry. A review of the Swiss patent landscape and the research programs of the funding agencies reveals increased activity in digitalization and data-handling technologies such as Blockchain software platforms for digital assets. Biotechnology as a platform technology affects various industry segments and also fuses with other technology fields such as information or production technologies. These technology fusions will further enlarge the classic biotech industry base by incorporating companies from outside the biotech sector.

Resilience: Swiss biotech is versatile, it includes suppliers, service organizations and companies from product development to manufacture and global distribution in various industry sectors. The presence of all expertise and biotech stakeholders within a rather small geographic area is one of the key strengths of Swiss biotech and the cause of its resilience.

This is reflected in the fact that most merger and acquisitions have not resulted in job losses for Switzerland. On the contrary, activities continued and investments into production and research infrastructure in Switzerland were maintained. In 2015, alongside the 14,890 persons employed in Swiss-based biotech companies (Swiss Biotech Report), 72 international companies were active in pharmaceutical production and employed another 13,058 persons in Switzerland (bfs.ch).

Outlook on evolution

Looking to the future, it is vital to position biotechnology as the means to address global challenges and risks and to contribute to global sustainable solutions. At the same time, benefits have to be demonstrated not just in theory but especially in practice. Technology transfer and fast movers in industry are essential elements in bringing innovation to market and changing the world by enabling global access and affordability.

And for the Swiss biotech industry, it is vital that the high standards of “Swiss Made” are visible and in-place. If framework conditions strengthen Swiss based research and manufacture and Swiss legislation governing risks is applied, then the country’s high standards will be transmitted worldwide through international trade.

Switzerland is no island and the biotech industry and research institutions are in a constant state of flux, exchange and international competition. The entity developing drugs in the future will have to rely on seasoned organizations for clinical research and contract manufacture as well as on a healthy and robust biotech industry to manufacture and market drugs. The question is, who will undertake these projects; the lowest bidder, national providers or the most suited and qualified? National and international governance may be able to reduce the likelihood and impact of global risks but we need informed consumers, end-users and purchasers in society and industry to take responsibility for reducing risk and promoting good governance through their own purchasing decisions.