- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Tuesday, May 7, 2019 @ 12:20 am

Roivant Sciences was founded in New York by a young investor and entrepreneur, Vivek Ramaswamy. In 2016, the company opened its global headquarters in Basel, Switzerland. Sascha Bucher, Head Basel Roivant Pharma and Head of Global Transactions, talks with Switzerland Global Enterprise about his company’s game-changing business model and why Basel is the perfect place to be.

Sascha Bucher

Head Basel Roivant Pharma and Head of Global Transactions

Interviewed by:

Sirpa Tsimal

Director Investment Promotion Switzerland Global Enterprise

What did Roivant find in Basel that it didn’t have in New York? What were the key factors in your company’s decision to select Switzerland as a new location?

We selected Basel on account of the city’s deep and diverse talent pool and its central location in the heart of Europe. Basel is home to two of the world’s largest pharmaceutical companies – Novartis and Roche – but it also serves as a regional headquarters for many other pharma companies and is a leading hub for many smaller biotech and medical device companies.

“Having operations in Basel makes it easy for us to hire experts across the entire biopharma value chain, from academic and industrial research to CMC (chemistry, manufacturing and controls) and formulation to clinical development and commercial operations.”

Basel has been a hub for the life sciences and complex manufacturing for a very long time. It dates back to the arrival of Huguenot refugees in the sixteenth century. They established Basel’s silk ribbon industry and laid the foundation for the city’s export-oriented chemical and pharmaceutical industries.

I should also note that the regional authorities for the canton of Basel-Stadt and the team at BaselArea.swiss (investment and innovation promotion of the Basel region) make it very easy for companies to establish operations in the city and plug into existing networks for partnerships and recruiting.

Roivant’s philosophy is game-changing in terms of talent acquisition and financing: With Axovant you’ve had the biggest biotech IPO in US history; with Myovant you’ve had the largest biotech IPO in 2016; and the USD 1 billion invested in Roivant by Softbank was the largest VC funding in Europe in 2017. What is the key to your success?

We hire top drug developers from within biopharma, but we also look outside the industry for fresh perspectives. We recruit top talent from tech, finance, academia, and other sectors. We see the catalytic combination of industry expertise with ideas from outside biopharma as a key element of our culture.

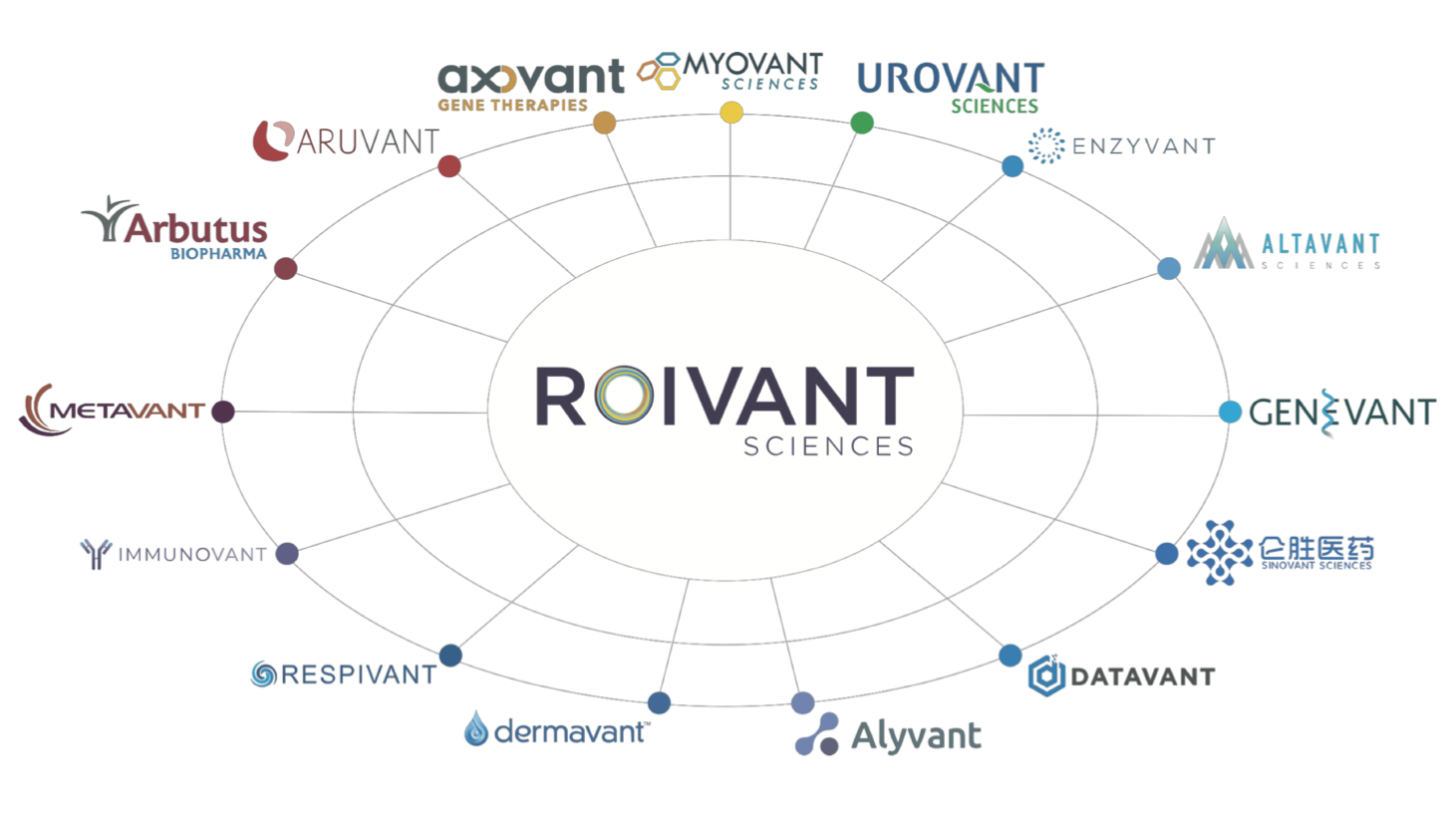

We have a unique decentralized model that is intended to better align the incentives of individuals working on development programs, and that model allows for greater flexibility in how we finance R&D. This brings down the total cost of capital. We are also always open to new opportunities. For example, we established a company in China called Sinovant which is focused on partnering with Western biopharma companies to develop innovative medicines in China. In a little over a year of operations, it has already built one of the leading pipelines for late-stage therapies in China.

Big Pharma is changing: Old business models no longer work and new players are entering the scene. Where do you see Roivant in this changing environment?

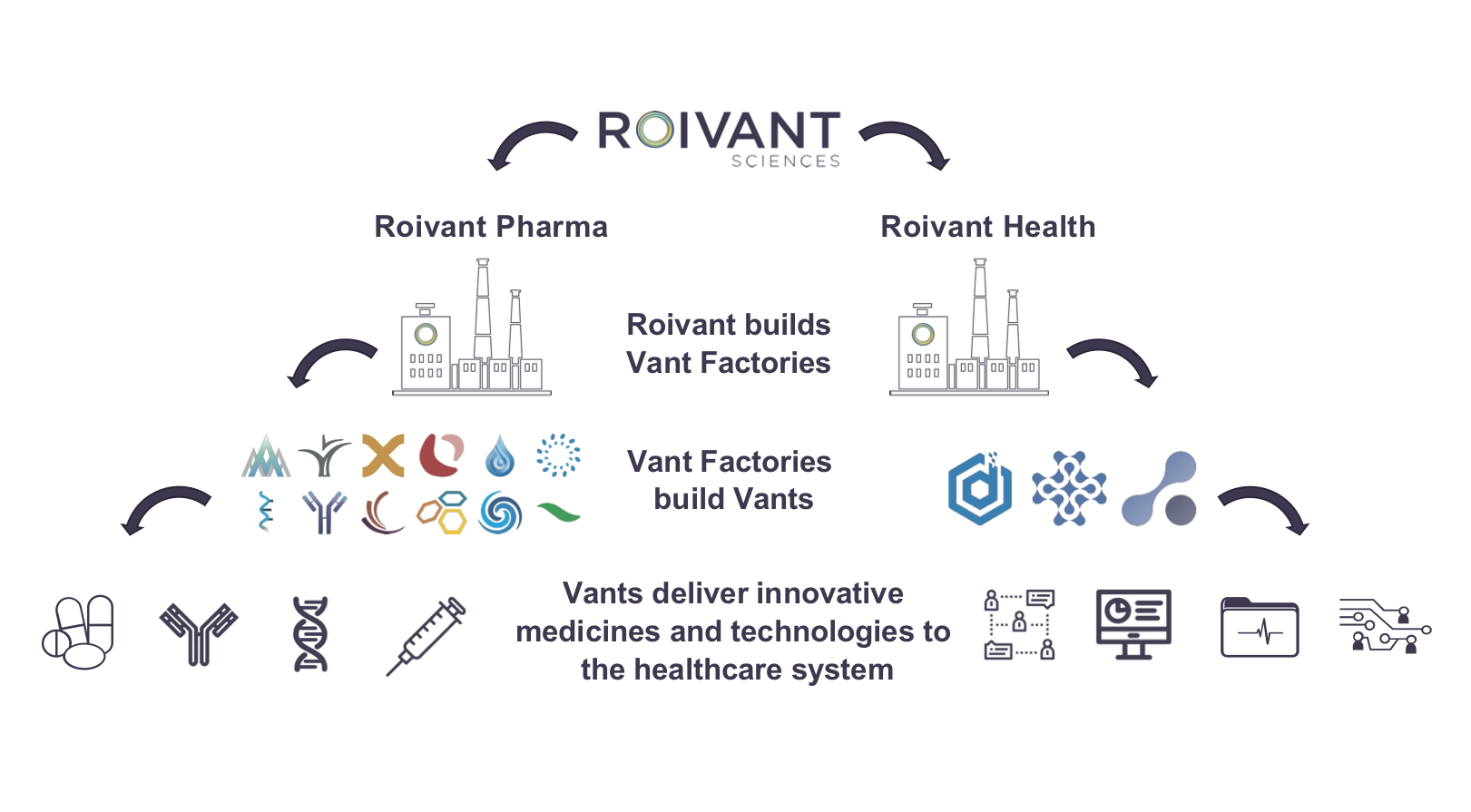

We see ourselves as reinventing what a large pharma company of the future might look like. Instead of a single and centralized organization, we are building the ‘Alphabet of Healthcare’; a decentralized family of companies working to improve the process of developing and delivering medicines to patients. Each of those companies in our ecosystem benefits from being a part of that broader family backed by Roivant.

Other companies have adopted similar models, such as Bridge- Bio which is focused on developing therapies for rare diseases, and we see this as a positive trend. Some large pharma companies have tried to decentralize elements of their operations, but we believe it will prove more difficult to retrofit existing companies instead of starting from scratch.

What will you focus on next? Which therapeutic areas have the potential to become the next members of your Vant family?

Roivant’s business model involves building nimble, entrepreneurial biotech and healthcare technology companies with a unique approach to sourcing talent, aligning incentives, and deploying technology to drive greater efficiency in R&D and commercialization.

“We are open to all modalities and therapeutic areas: if we see value for patients, we are interested.”

Our pipeline today includes small molecule pills being developed for the treatment of urological, cardiometabolic, pulmonary, and women’s health conditions; topical ointments for inflammatory skin diseases; subcutaneous monoclonal antibodies for autoimmune diseases; gene therapies for neurological and haematological diseases; enzyme replacement and regenerative therapies for ultra-rare diseases; drug-device combinations for respiratory conditions, and potential RNA-based therapeutics.

That is just a selection of what we are working on today. We see potential near-term opportunities in anti-infectives and oncology, and there is no inherent limit to the number of potential Vants we intend to build so I expect that in time our pipeline will eventually include therapies in most, if not all, therapeutic areas.

New technologies are also entering the world of healthcare. Artificial intelligence and blockchain are currently on everybody’s mind. What is your take on that?

They are largely buzzwords when it comes to healthcare today. What is far more important is collecting and joining healthcare datasets between and within institutions. We believe that is the rate-limiting step to unlocking insights which improve human health and that is the thesis of Datavant. Datavant works with data owners and users across the healthcare industry to ensure that health data can be safely and appropriately linked to power analytics and applications, while safeguarding individual patient privacy.

In our view, Switzerland with its impressive talent base and openness to new ideas has positioned itself well to adapt those new technologies.

What would be your advice for growing biotech companies that are expanding to Europe?

We have had a very positive experience and we would strongly encourage them to consider Basel.

“Basel is an ideal location for a growing biotech company and Switzerland is a very welcoming place for business to be conducted.”

In terms of challenges, it may sound mundane but it is very important to have a thorough plan in place to ensure communication across offices in multiple time zones, including investments in videoconferencing technology.

Switzerland Global Enterprise (S-GE) works all over the world to support entrepreneurs and promote Switzerland as a business location. In its role as a center of excellence for internationalization, its mission is to help clients develop new potential for their international business and to strengthen Switzerland as an economic hub. S-GE, with a global network of experience advisers and experts, is a strong and trusted partner for its clients, the cantons and the Swiss government. For more information, visit www.s-ge.com, www.s-ge.com/invest-biotech