- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Monday, May 5, 2025 @ 11:00 am

SIX Swiss Exchange reviews publicly listed companies included in ‘Highlights of 2024: Year in Review’ (Pages 52 to 55). While Santhera and Kuros made good progress, SIX recognizes the notable success of Basilea which, 20 years after its IPO in 2004, has reported increasingly robust profits.

Fabian Gerber

SIX Swiss Exchange AG | Head Origination, Primary Markets

Basilea, a cornerstone of the Swiss biotech scene and an important player in the field of innovative therapies, looks back on a successful performance during 2024. With its partner-centric business model focused on anti-infectives, the SIX-listed biotech company strengthened its position and made significant progress in its financial performance, reporting a strong operating profit of CHF 61 million. The company continued to generate significant positive cash flow and ended the year with a strong liquidity position of CHF 125 million.

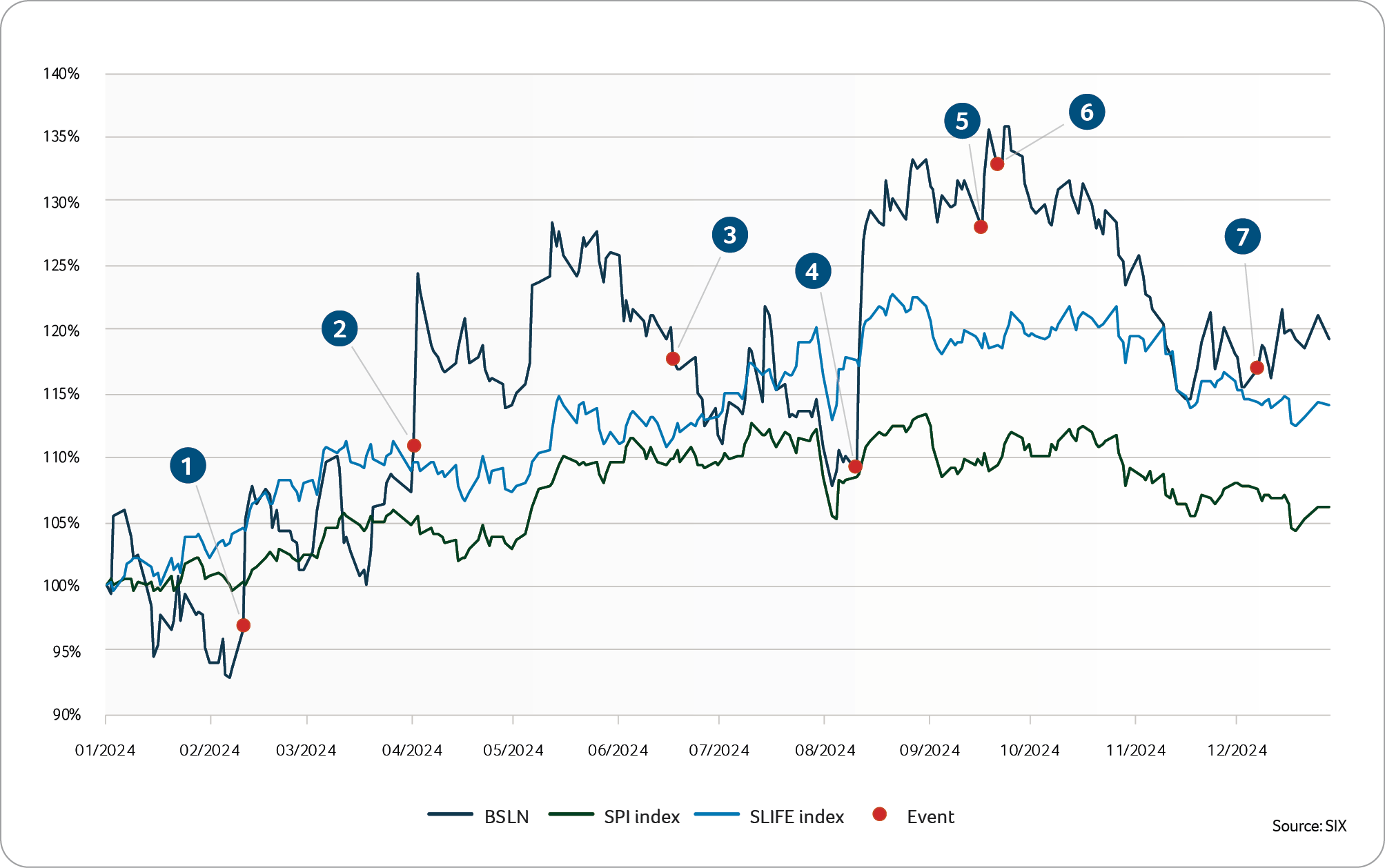

Figure 1 shows that the share price increased significantly over the course of the year, particularly following the announcement of regulatory approvals, financial results and new partnerships. With an annual return of 19.2%, Basilea outperformed both the SPI (+6.2%) and the SLIFE Index (+14.2%). Several analysts raised their price targets, reflecting the positive progress.

The Basilea business model is focused on partnerships. From the very start, it has acquired and in-licensed innovative therapies sourced from small biotech to big pharma across the globe. Basilea has also accessed non-dilutive funding partnerships which offset a significant proportion of its research and development costs. For its global commercialization, Basilea has formed partnerships covering more than 100 countries, exemplified in 2024 with the new agreement for the commercialization of Zevtera® in the US. The value of commercial partnerships was further shown by the fact that one third of Basilea’s 2024 press releases related to the receipt of sales milestone payments from commercial partners. This also shows that its marketed products address needs in the market.

➊ On February 13, 2024, the 2023 annual results were published with a positive forecast. Profit exceeded expectations and total revenue growth of 20% was announced.

➍ Basilea reported strong half-year figures on August 13, 2024, and raised its forecast. Total revenue of CHF 196 million (+20%) and a net profit of CHF 42 million were projected for the full year.

Positive regulatory decisions and pipeline development

➋ On April 4, 2024, the FDA, the US regulatory agency, approved the antibiotic ceftobiprole (Zevtera) for the treatment of bloodstream infections, skin infections and community acquired pneumonia.

➏ On September 24, 2024, the start of a Phase III trial with fosmanogepix for the treatment of invasive fungal infections was announced.

Milestone payments and substantial non-dilutive funding

Driven mainly by the success of the antifungal Cresemba®, several milestone payments to Basilea were triggered in the past year, totaling CHF 39.1 million.

On January 19, 2024, Basilea announced a first milestone from Knight Therapeutics based on strong Cresemba sales in Latin America, followed by further milestones (on March 11, May 16, September 6, October 10, 2024) totaling USD 30 million from Pfizer, based on Cresemba sales in Asia and Europe. In addition, Basilea received a CHF 10 million milestone payment from Pfizer related to the extension of the market exclusivity of Cresemba in the EU. On January 28, 2025, Basilea announced that the 2024 sales of Cresemba in Canada and the Middle East / North Africa regions and the 2024 sales of Zevtera in Europe triggered further milestones amounting to a total of CHF 2.2 million.

➎ In addition, Basilea secured significant non-dilutive funding for its research and development activities. On September 19, 2024, Basilea announced an agreement with BARDA, part of the US government, for up to USD 268 million for the development of new antifungals and antibiotics. In December 2024, Basilea also received USD 7.3 million in funding for a pre-clinical antibiotic program from CARB-X, a US-based global consortium, after an initial USD 0.9 million was awarded in April 2024.

Strategic partnerships further expanded

➌ Asset purchase agreement with the Glioblastoma Foundation for Basilea’s oncology drug candidate lisavanbulin, on June 20, 2024. This marked the final exit from the cancer area, allowing the company to focus on anti-infectives going forwards.

➐ On December 10, 2024: Agreement with Innoviva Specialty Therapeutics to commercialize Zevtera (ceftobiprole) in the US. Basilea received an upfront payment of USD 4 million. In addition, potential milestone payments of up to USD 223 million as well as double-digit royalties on sales have been agreed.

Basilea has been listed on the SIX Swiss Exchange since 2004 and had a market capitalization of CHF 544.6 million as of December 31, 2024. With a solid financial position, a strong product pipeline and new partnerships, Basilea in 2024 has laid the foundation for future growth.

None of the information contained herein constitutes an offer or a recommendation to buy or sell or take any other action regarding financial instruments. SIX Group Ltd or its direct and indirect subsidiaries (hereafter: SIX) are liable neither for the completeness, accuracy, currentness and continuous availability of the information given, nor for any loss incurred as a result of action taken on the basis of information provided in this or any other SIX publication. SIX expressly reserves the right to alter prices or composition of products or services at any time.

© SIX Group Ltd, 2025. All rights reserved.