- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Thursday, May 3, 2018 @ 12:00 am

Switzerland has always been an important player in biotechnology and maintains its position amongst the leaders in the face of dynamic global developments. Since 2000, the Swiss biotech patent portfolio has grown significantly; in the first decade the focus was on quantity and thereafter the emphasis has been predominantly on quality. In 2017, half of the Swiss biotech patents qualified as world-class.

Heinz Müller

Swiss Federal Institute of Intellectual Property

Christian Moser

Swiss Federal Institute of Intellectual Property

Global versus Swiss patents

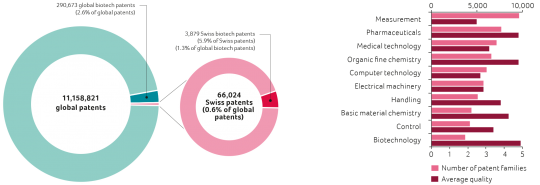

In 2017, approximately 290,000 or 2.6% of all active patent families worldwide related to biotechnology. The 66,000 active patent families of Swiss origin accounted for 0.6% of the global portfolio. This includes approximately 3,900 Swiss biotech patent families, representing 5.9% of the total Swiss portfolio. On this basis, the importance of biotechnology to the Swiss economy is substantially higher than it is globally.

Within the Swiss portfolio, nine other technology fields, including measurement, pharmaceuticals and medical technology, account for more patents than biotech. However, the biotech patents feature the highest average when it comes to ‘quality per patent family’, thus indicating that the Swiss biotech patents represent more economic value than the patent count suggests.

Quantitative growth 2000 to 2017

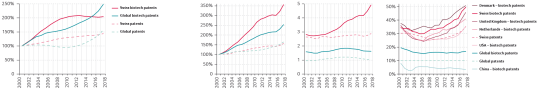

Between 2000 and 2010, the number of all active patents worldwide remained largely constant at around seven million. From 2010 to 2017, however, the number rose to eleven million. The reason for this was that over the last 10 years there has been a massive surge in the number of Chinese patents across virtually all technology fields, including biotechnology. As a result, China has replaced the USA as the world’s leading country of origin for numbers of biotech patents. The Swiss patent portfolio shows a modest yet constant increase in numbers over the 17-year period, resulting in a net growth similar to the global portfolio. The global biotech portfolio has grown faster and continuously as a consequence of substantial growth in North American and European countries during the first decade, and massive growth in China and South Korea starting around 2005.

The growth curve of Swiss biotech patents looks different. After strong initial growth in the period 2000–2010, the number of Swiss biotech patents has remained largely constant in recent years. Not surprisingly, the biotech portfolios of North American and most European countries of origin show a similar profile. One reason may be that many companies, in particular the large ones, have consolidated their biotech patent portfolios during the past decade and are pursuing a patent strategy focused on quality rather than quantity.

Qualitative growth 2000 to 2017

In contrast to the quantity of patents, the quality of patents provides a differentiated view of the value of a technology to a particular economy. The cumulated portfolio value, the average portfolio quality, and the percentage of world-class patents represent three distinct approaches to assessing and comparing the quality of patent portfolios.

PatentSight assigns quality parameters to each patent family. The Competitive Impact™ used in this report as quality indicator is the product of the parameters Technology Relevance™ relating to the number of citations received and the Market Coverage™ referring to the market size protected by the respective patent family. The Patent Asset Index™ represents the cumulated business value of a patent portfolio, calculated as the sum of the competitive impacts of the patents included therein.

Over the past 17 years, all four patent sets (Swiss, Swiss biotech, global, global biotech) show a continuous increase in cumulated portfolio value. However, the growth rates differ significantly: overall global and overall Swiss portfolio values grew about 50% in the period 2000–2017 while the value of biotech portfolios grew much faster with the Swiss biotech portfolio registering a remarkable 350% growth in value over that period. In contrast, the average portfolio quality, i.e. the cumulated portfolio value divided by the number of patents, remained largely constant for both global portfolios and the overall Swiss portfolio, albeit at different levels. Thus, none of these portfolios showed an improvement in average quality over time. In contrast, the value for the Swiss biotech patents has continuously increased over the last 15 years, reflecting sustained qualitative growth.

World-class patents are defined as the top ten percent of all patent families by business value. By definition, the global portfolio constantly includes a share of 10% of world-class patents. The global biotech portfolio displays a slightly higher percentage, with little change over time. In contrast, both Swiss portfolios comprise a substantially higher percentage of worldclass patents and this has been constantly increasing over the last 10 years. By 2017, over 30% of all Swiss patents and 50% of the Swiss biotech patents qualified as world class. Among the top 12 countries of origin for biotech patents, Switzerland ranks second after Denmark since 2003, followed by the United Kingdom and the Netherlands.

As with all high-tech sectors, the biotech sector strongly relies on patents as a means to protect its products. Accordingly, patent data and technology categorizations represent a reliable source of information. Biotechnology is one of 35 technology fields defined by the World Intellectual Property Organization (WIPO).

Note: The patent data were processed with the software PatentSight, based on patent families. A patent family condenses all patent documents relating to a specific invention, as defined by an initial priority application. Only active patent families, i.e. those in force or pending at a given point in time, are included in the evaluation. The country of origin for patents is determined via the inventor’s addresses provided in the patent applications.

The Swiss Federal Institute of Intellectual Property is the official government body for intellectual property rights in Switzerland and is responsible for examining, granting and administering these rights. The Institute’s services also include training courses on various aspects of intellectual property and tailor-made searches for trademarks and patent information, including strategic patent analyses involving patent quality parameters. For further information visit https://www.ige.ch.