- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Tuesday, April 23, 2024 @ 11:00 am

Switzerland’s capital-rich investor base, strong financial system and leading industry know-how support the country’s vibrant biotech ecosystem, enabling companies to efficiently raise capital with a view to driving scientific discovery through to market launch. This benefits both local startups and global players in the life sciences sector. New requirements for sustainability reporting and increased transparency on non-financial matters will necessitate additional effort but will also offer new opportunities and address stakeholder demands.

Fabian Gerber

SIX Swiss Exchange AG | Senior Relationship Manager Primary Markets

The healthcare industry accounts for around one-third of the total market capitalization of all SIX Swiss Exchange-listed companies. The high concentration of pharma, biotech and medtech companies in Switzerland is no coincidence. Longstanding interaction between the well-established Swiss companies in the sector and Switzerland’s financial institutions have helped foster a fruitful environment that sustains not only domestic investor knowledge, but also attracts international attention.

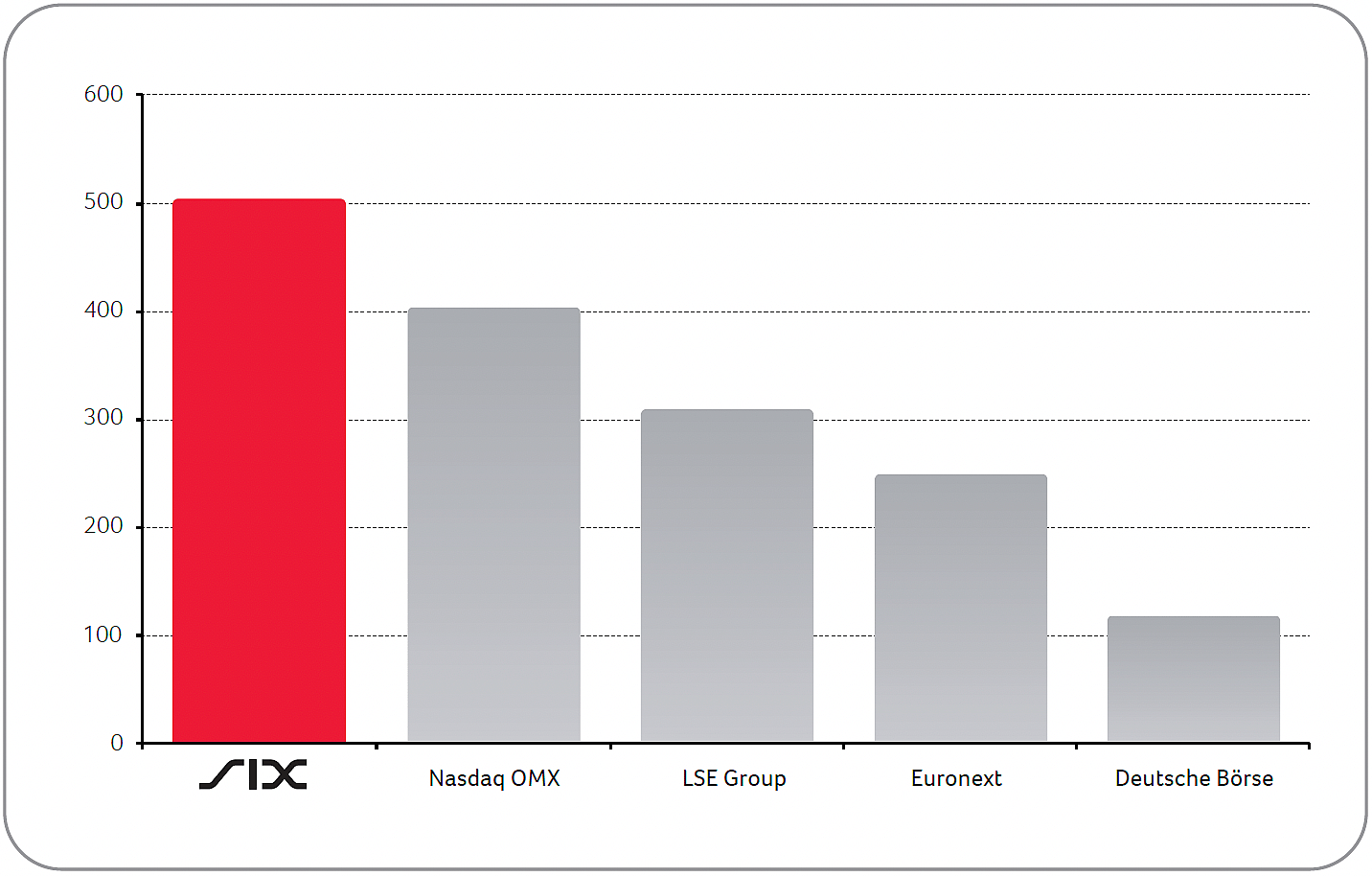

The two sector indices SXI Life Sciences® and SXI Bio+Medtech® enhance the industry’s visibility in the financial market and have a positive impact on liquidity. Figure 1 highlights the size of the SIX Swiss Exchange healthcare sector compared to other European exchanges.

Environmental, Social and Governance (ESG) is here to stay

The topic of “sustainable business”, often equated with the term ESG, has become firmly established on global political agendas in recent years. Many agree that climate targets will not be achieved without concrete measures and that doing nothing will result in irreversible environmental damage. In view of the new legal requirements, many companies, whose contribution to fulfilling these goals will be essential, aim to become more transparent on ESG.

Stakeholders of biotech companies are increasingly engaging directly and indirectly to demand more sustainable business development and good corporate citizenship. While companies from other sectors must focus on “E” for Environmental in ESG due to their high Scope 1 emissions (direct greenhouse emissions, e.g. those resulting from fuel combustion in boilers, vehicles, etc.), biotech companies are faced with increased reporting requirements and the need for transparency with regard to social metrics (e.g. patient and employee safety, ethical business practices, animal testing, responsible R&D, safety in clinical trials, etc.).

industry as per year-end 2023 (in EUR billion)

New reporting requirements

To keep up with international developments, including EU legislation, Switzerland has introduced reporting obligations on non-financial matters.

Most importantly, on 1 January 2023, the new Articles 964a to 964c of the Swiss Code of Obligations came into force. This means that affected companies are now required to publish a sustainability report. The new legislation applies to:

- public-interest entities (as defined by the Auditor Oversight Act), i.e., FINMA-regulated financial institutions, listed Swiss companies¹, and issuers of bonds²

- companies that have at least 500 full-time employees in two consecutive financial years on a consolidated basis (i.e., including all controlled companies³; and exceed at least one of the following in two consecutive financial years: (i) a balance sheet total assets of CHF 20 million, or (ii) a turnover of CHF 40 million

How SIX Swiss Exchange-listed companies have coped with ESG so far

A survey of 496 CFOs and IR officers ⁴ from SIX-listed companies conducted in August 2023 showed that over 80% of companies are either ready or at least well advanced in terms of preparing a sustainability report to fulfill the regulatory requirements. The picture is somewhat different for climate reporting, where only 8% say that they are ready and almost 50% say they have still a lot of work to do.

Companies mentioned the preparation of relevant data and information management as the biggest challenges, necessitating additional resources, such as internal control systems. In 33% of the companies, at least one employee works specifically in the area of sustainability, and 46% stated that they had nominated at least three employees (both part- and full-time employees) to be responsible for this purpose.

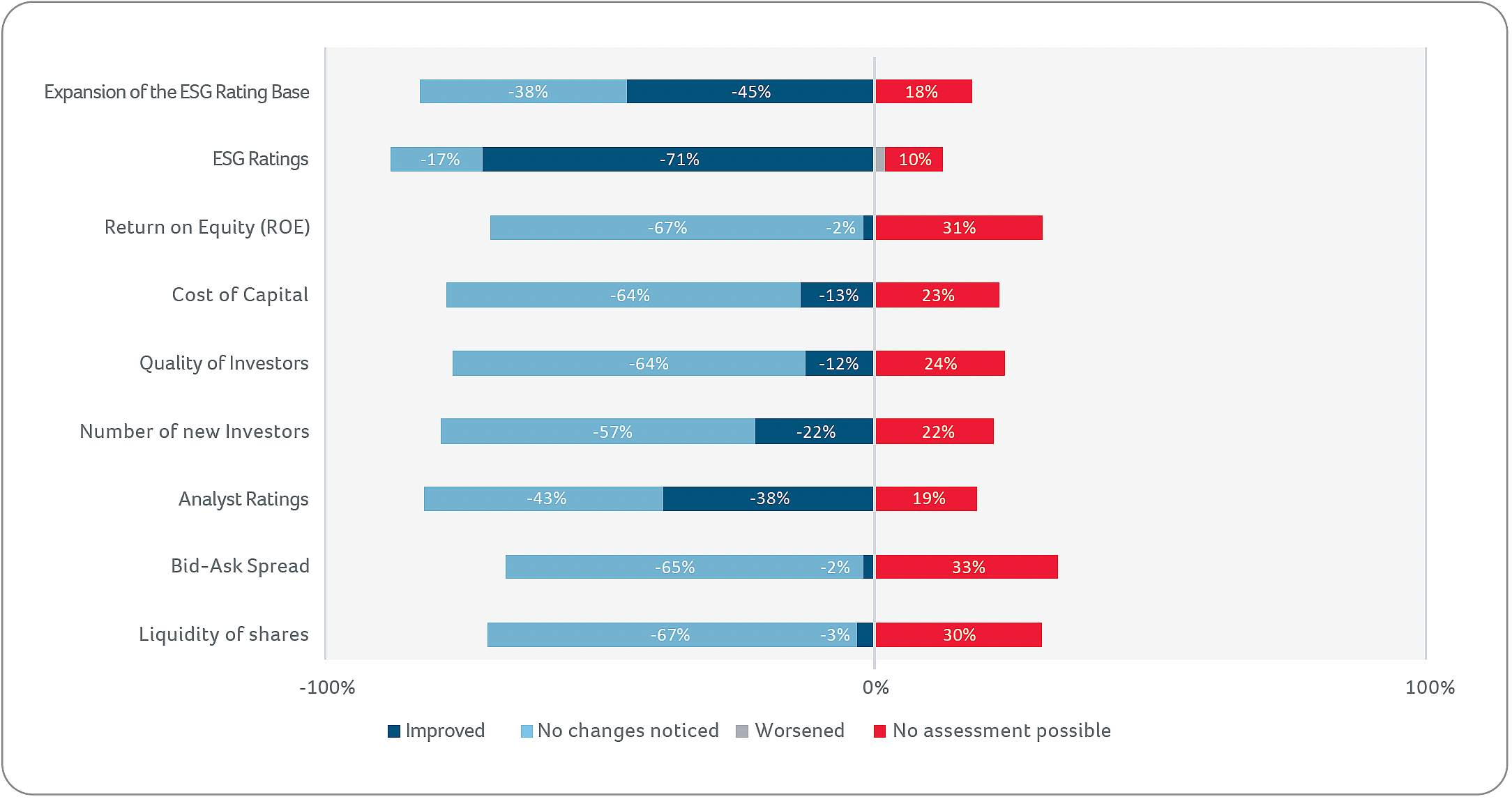

Many respondents said that their sustainability report had simplified communication with stakeholders and generally strengthened their perception as ESG leaders or had given them the opportunity to position themselves accordingly vis-à-vis stakeholders. Companies which had previously voluntarily prepared a sustainability report in accordance with an internationally recognized standard stated that this had resulted in an increase in ESG rating coverage, and improvement in their ESG ratings and analyst forecasts. Most of these companies said that they had so far been motivated to produce such a report as it was requested from their stakeholders, who demanded more transparency.

There is also a positive, albeit less pronounced, trend towards an increase in the number and type of investors (“sustainability-driven” investors), whereas a positive correlation between the cost of capital and the preparation of a sustainability report was only observed to a limited extent (see Figure 2).

How SIX supports its listed companies

Stock exchanges such as SIX Swiss Exchange can augment sustainability transparency for investors by helping listed companies disclose non-financial information.

Since 1 July 2017, a provision has been in force that enables voluntary sustainability reporting for companies listed on SIX Swiss Exchange (so called “opting-in”), which will also be maintained after the entry into force of the law⁵ beyond 2023. By means of an “opting in”, issuers have the possibility to inform the market participants and the stock exchange regulator that they will prepare a sustainability report in accordance with an internationally recognized standard. To date, around 50 SIX Swiss Exchange-listed companies have chosen to opt in and cited as reasons the additional visibility and credibility due to the alignment with SIX-requirements. Figure 3 highlights further key initiatives and activities of SIX in supporting its issuers:

SIX key initiatives to support sustainability

1 Flagging of sustainable bonds with a positive sustainability contribution:

https://www.six-group.com/en/productsservices/the-swiss-stock-exchange/marketdata/bonds/sustainable-bonds.html

2 SIX Sustainability Handbook:

https://www.six-group.com/dam/download/the-swiss-stock-exchange/listing/equity/services-for-equity-issuers/sustainability-handbook-en.pdf

3 Creation of new SIX ESG equity indices (SPI ESG Index, SPI Gender Equality Index, etc.):

https://www.six-group.com/en/products-services/the-swiss-stock-exchange/market-data/indices/esg-indices.html

4 Dedicated training sessions in the area of sustainability and climate reporting for issuers:

Best in Class Sessions, Workshops⁶

5 SIX collaboration with UZH for new education program:

https://www.finance-weiterbildung.uzh.ch/en/programs/cas/cas-stakeholder-management-and-stewardship.html?utm_source=six&utm_medium=generisch

6 ESG Data Hub:

https://www.six-group.com/en/productsservices/financial-information/esg-data/esgdata-hub.html

References

1 The term “listed” is not limited to Swiss stock exchanges but is also applied to companies that are listed on a foreign stock exchange.

2 It is not a prerequisite that bonds are listed in order to fall under this provision.

3 Art. 963 para. 2 defines “control” as a legal entity that controls another company if it: (I) directly or indirectly holds the majority of votes in the supreme governing body, (II) directly or indirectly has the right to appoint or remove the majority of the members of the supreme management or administrative body; or (III) can exercise a controlling influence on the basis of the articles of association, the foundation deed, a contract or comparable instruments.

4 With 150 people completing the survey, the response rate was 30.2%.

5 Articles 964a to 964c of the Swiss Code of Obligations.

6 In cooperation with UNSSEi.