- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Tuesday, April 20, 2021 @ 10:00 am

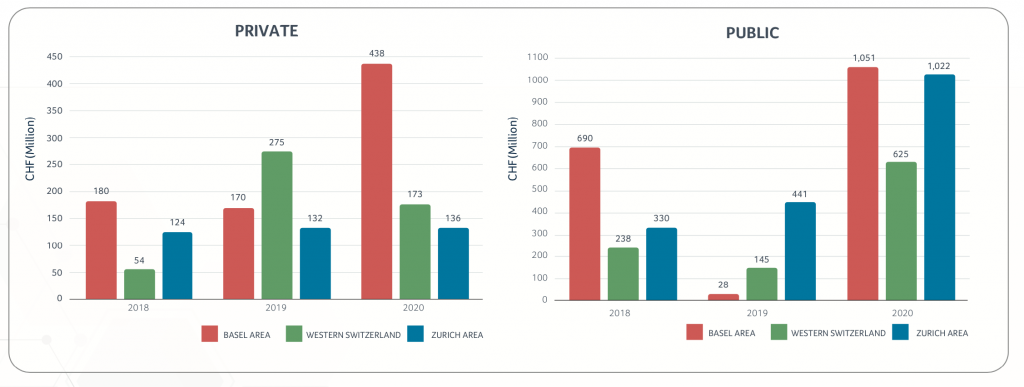

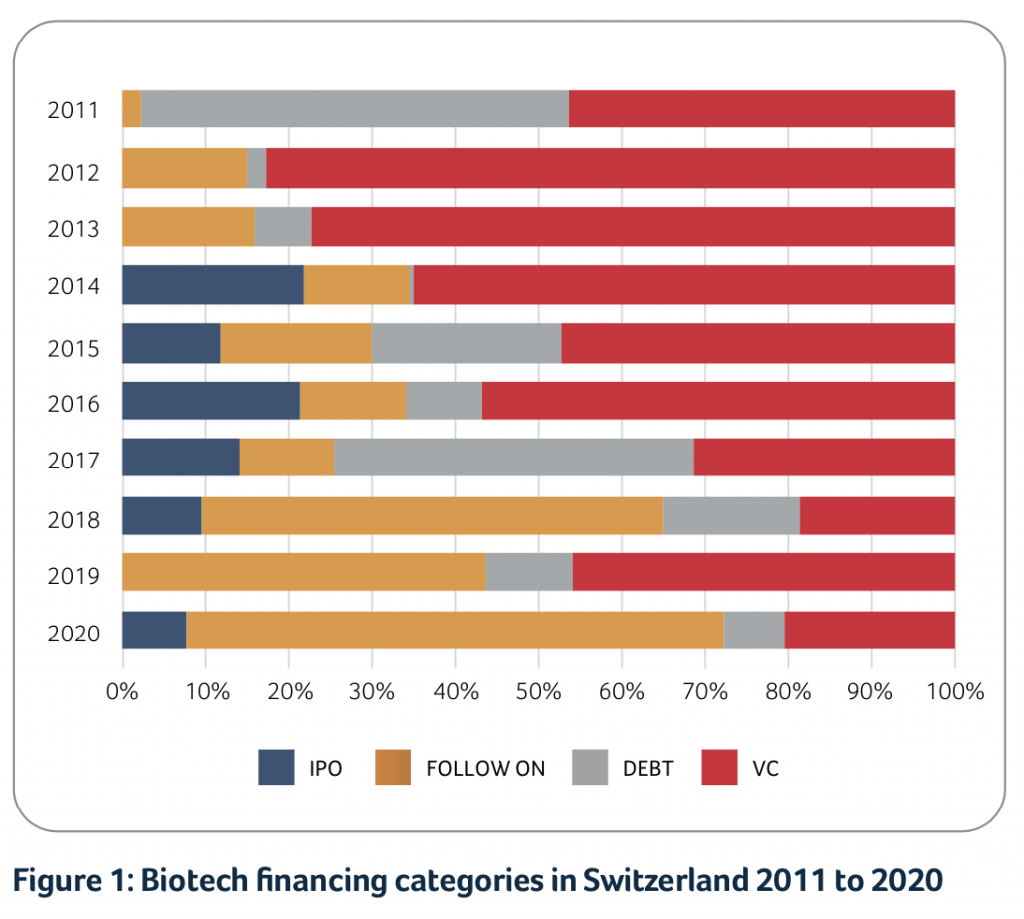

2020 was the best year ever for Swiss biotech in relation to financing activities, with a total of approximately CHF 3.4B raised. The industry’s R&D spending was up 10%, while record FDA and EMA approvals were obtained, preparing the ground for future performance.

Jürg Zürcher

Partner, GSA Biotechnology Leader, EY

Frederik Schmachtenberg

Partner, Financial Accounting Advisory Services, EY

The global IPO class of 2020 was playing in a league of its own with a total of 84 IPOs (2019: 57), which generated more than USD 13.4B (2019: USD 6.4B) of new capital. Some 76 US IPOs were able to raise fresh money to the tune of approximately USD 12.7B (2019: 46 US IPOs / USD 5.6B). Besides the traditional IPOs, a little over one third of the newly public companies were using Special Purpose Acquisition Companies (SPAC) structures to become listed companies. Further, of the total global IPOs of 84, 8 were European IPOs, raising USD 0.7B (2019: 11 European IPOs / USD 0.8B).

Swiss biotech landscape

The Swiss biotech industry generated revenues of CHF 4.5B, compared to CHF 4.8B in 2019. This drop in revenues was mainly driven by favorable one-time events in 2019 (relating to AC Immune, Basilea and CRISPR) which didn’t recur in 2020. Nevertheless, higher revenues for those biotechs selling marketed products/services continued to be achieved.

Swiss biotech financing

2020 was the best year ever for Swiss biotech in relation to financing activities, with a total of approximately CHF 3.4B raised.

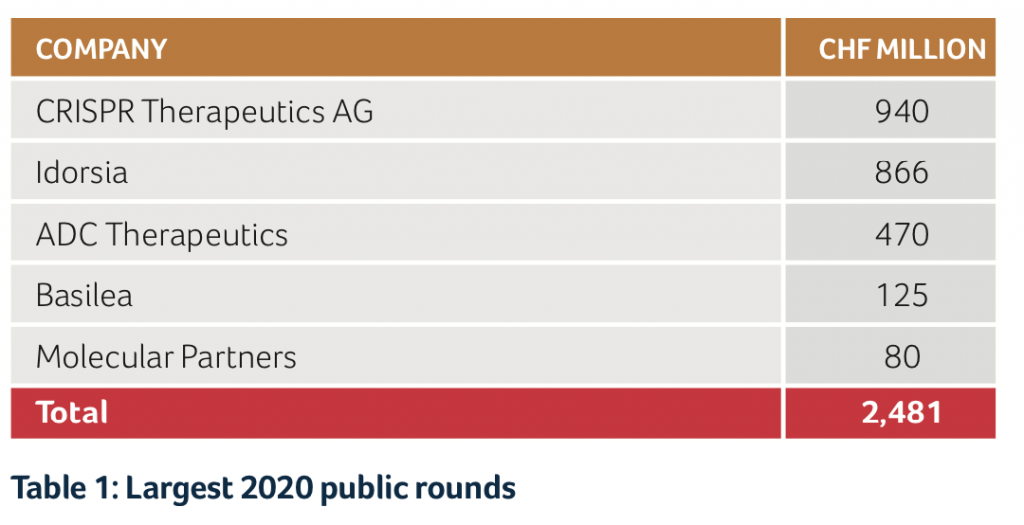

Public companies were able to collect almost CHF 2.7B of fresh capital. This included the successful IPO of ADC Therapeutics from Lausanne on NYSE, which raised approximately CHF 260M, with the implementation of follow on financing in the fall for an additional CHF 210M. Other significant “cash collectors” were CRISPR Therapeutics with more than CHF 940M, Idorsia with CHF 866M and Molecular Partners with CHF 80M. Further, Basilea made use of the attractive interest environment, replacing an existing convertible loan with a new one of CHF 125M.

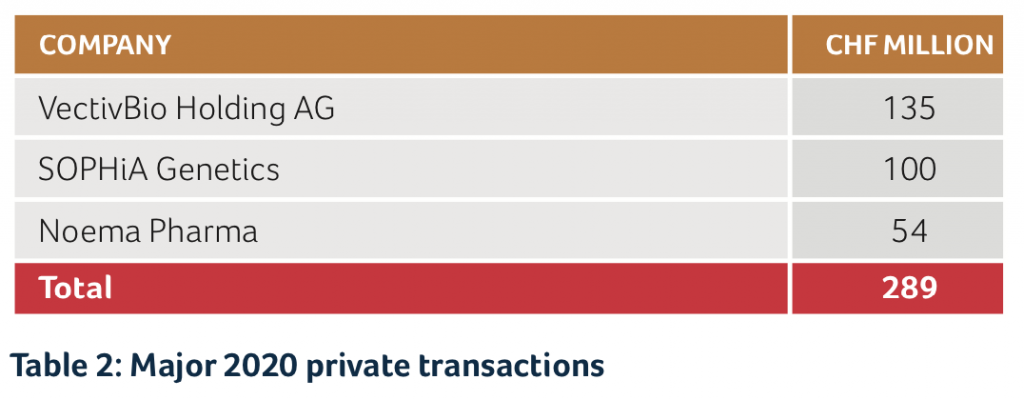

The biggest portion of the private capital was raised by VectivBio Holding AG in a combination of equity and debt financing totaling CHF 135M. SOPHiA Genetics was also able to raise CHF 100M and the newly founded company Noema Pharma got an initial capital injection from the founding VCs of CHF 54M.

“2020 was the best year ever for Swiss biotech in relation to financing activities, with a total of CHF 3.4B raised”

M&A and collaborations

Several Swiss biotech companies were also acquired in 2020 by either (big) pharma or other biotech companies. The following brief snapshot lists the most prominent transactions in 2020:

- Sumitomo Dainippon Pharma and Roivant Sciences completed their strategic alliance and the formation of a new company, Sumitovant Biopharma, a wholly owned subsidiary of Sumitomo Dainippon Pharma. Roivant received USD 3B from Sumitomo Dainippon Pharma in connection with this deal.

- Genkyotex announced the closing of the acquisition by Calliditas Therapeutics of a controlling interest in Genkyotex

- Boehringer Ingelheim acquired NBE-Therapeutics for EUR 1.18B, significantly enhancing its cancer pipeline portfolio with novel Antibody-Drug Conjugates (ADCs).

The Swiss biotech sector was successful not only on the financing front but also in the area of collaborations and licensing arrangements, and several successful new partnerships were established in 2020. Amongst those were:

- BC Platforms’ partnership with Dante Labs to build Europe’s largest Next Generation sequencing laboratory

- Genedata and the Crohn’s & Colitis Foundation’s collaboration to improve patient care in Crohn’s disease

- Evolva’s new collaboration agreement with International Flavors and Fragrancies (IFF) to further develop and expand commercialization of vanillin

- Moderna and Lonza’s worldwide strategic collaboration to manufacture Moderna’s vaccine (mRNA-1273) against novel coronavirus

- Santhera’s agreements in gene therapy research for congenital muscular dystrophy with Rutgers University

- BioMarin boosting its early-stage pipeline by penning a deal with Swiss startup Dinaqor

- Neurocrine Biosciences’ option exercise to license Idorsia's novel treatment for rare pediatric epilepsy

- Boehringer Ingelheim’s collaboration with CDR-Life to develop antibody fragment-based therapeutics for geographic atrophy, a leading cause of blindness worldwide

- Numab Therapeutics and Boehringer Ingelheim’s collaboration to develop multi-specific antibody therapeutics for cancer and retinal diseases

- BioVersys and partners from Lille signing a long-term collaboration agreement to create a unique cross-border AMR cluster in antimicrobial research excellence

- Memo Therapeutics AG and Northway Biotechpharma’s new partnership to manufacture the startup’s therapeutic COVID-19 antibody candidate

- Santhera’s option exercise to obtain worldwide rights to Vamorolone in Duchenne muscular dystrophy and all other indications

- NBE-Therapeutics and Exelixis’ new partnership to develop novel antibody-drug conjugates using NBE’s unique ADC platform

- Polyphor’s closing of Fosun Pharma licensing agreement for balixafortide in China and receipt of USD15M upfront payment

- Molecular Partners’ collaboration with Novartis to develop two DARPin® therapies designed for potential use against COVID-19

Product development

In 2020, the industry saw more approvals by the FDA (57 compared to 48 in 2019), all granted within a review period of less than a year, and there was also an increase of almost 50% in European approvals by EMA (97 compared to 66 in 2019). Swissmedic itself approved 42 new drugs in 2020, which was over a third more than the 29 approvals for innovative new drugs in 2019.

Nevertheless, there were also some setbacks to be noted during 2020. For example, Santhera Pharmaceuticals reported in October 2020 that the Phase III results for the SIDEROS study in DMD did not meet expectations, which led to restructuring of the company.

Several Swiss biotech companies received awards in 2020:

- Great Place to Work® certified Selexis as a Best Workplace in Switzerland for the third consecutive year

- AC Immune won a prestigious award to develop a “Game-Changing” Parkinson’s diagnostic tool

- InSphero’s InFloatTM Microtissue Shipping System won the coveted Red Dot Best of the Best Award for product design

- ETH Zurich spin-off deep CDR Biologics won CHF150K from Venture Kick

- Alithea Genomics, LifeMatrix Technologies and MimiX Biotherapeutics each won CHF 40K

- CUTISS won the Top 100 Swiss Startup Award 2020

- Madiha Derouazi, founder and CEO of Amal Therapeutics, was among the winners of the EU Prize for Women Innovators 2020

CRISPR Therapeutics Co-Founder Emmanuelle Charpentier received the 2020 Nobel Prize for Chemistry

All of these awards are yet another clear indication of the strength of the Swiss biotech sector and a reflection of all of the significant progress made over recent years.