- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Tuesday, April 25, 2023 @ 7:00 am

In 2022, the global biotech sector, like many other sectors, was impacted by geopolitical challenges, which dried up or reduced some sources of funding. However, with the impact of the pandemic diminishing (thanks to the new mRNA vaccination capabilities) the “new world” also brought welcome relief to the healthcare sector around the globe.

Frederik Schmachtenberg

EY | Partner, Global Health Sciences & Wellness Lead for Financial Accounting Advisory Services

Helena Rosa

EY | Senior Manager, Global Health Sciences & Wellness, Audit Services

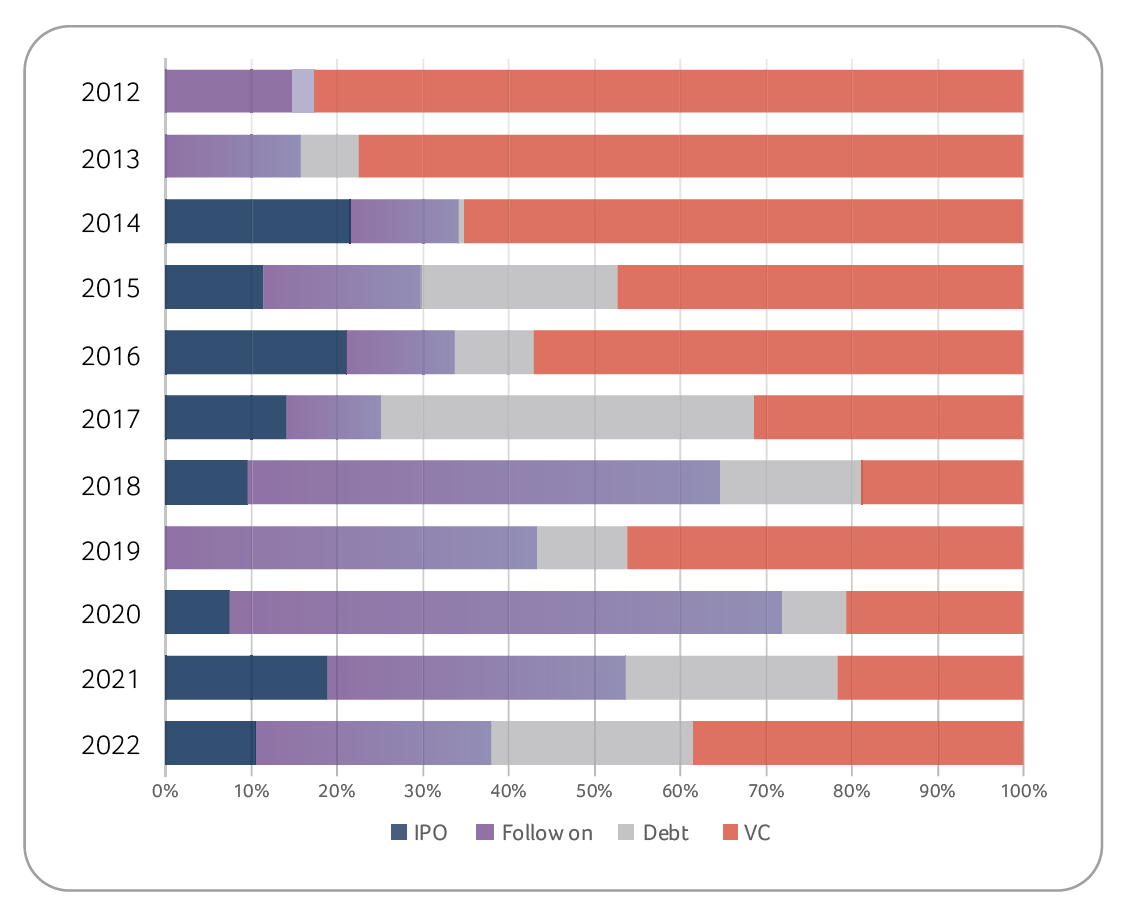

Biotech IPOs suffered from these global developments with a significant drop in the number of companies going public. SPAC transactions were no longer “en vogue”, with only very few SPAC transactions in 2022 compared to 2021. Globally, the IPO class of 2022 counted only 22 IPOs (2021: 143), which generated approximately USD 1.5 billion in funds (2021: USD 19.3 billion).

17 US IPOs (2021: 99) were able to collect a total of USD 1.3 billion (2021: USD 15.7 billion).

In Europe, biotechs successfully completed 5 IPOs (2021: 44), raising USD 0.2 billion (2021: USD 3.6 billion).

Swiss biotech landscape

In 2022, the Swiss biotech industry saw new records in terms of revenues recognized (CHF 6.8 billion in 2022 compared to CHF 6.7 billion in 2021) as well as in R&D investments (CHF 2.7 billion in 2022 compared to CHF 2.6 billion in 2021). In line with this, the number of FTEs working in Swiss R&D biotech companies increased to more than 19’100 FTEs (year-on-year increase by 7.2%), which is also a new record high. Not surprisingly, and especially in view of the challenging environment for raising funds in 2022, these new records in terms of growth and R&D investments came at the price of companies needing to reduce some of their liquidity reserves (on average by 21% in 2022).

Swiss biotech financing

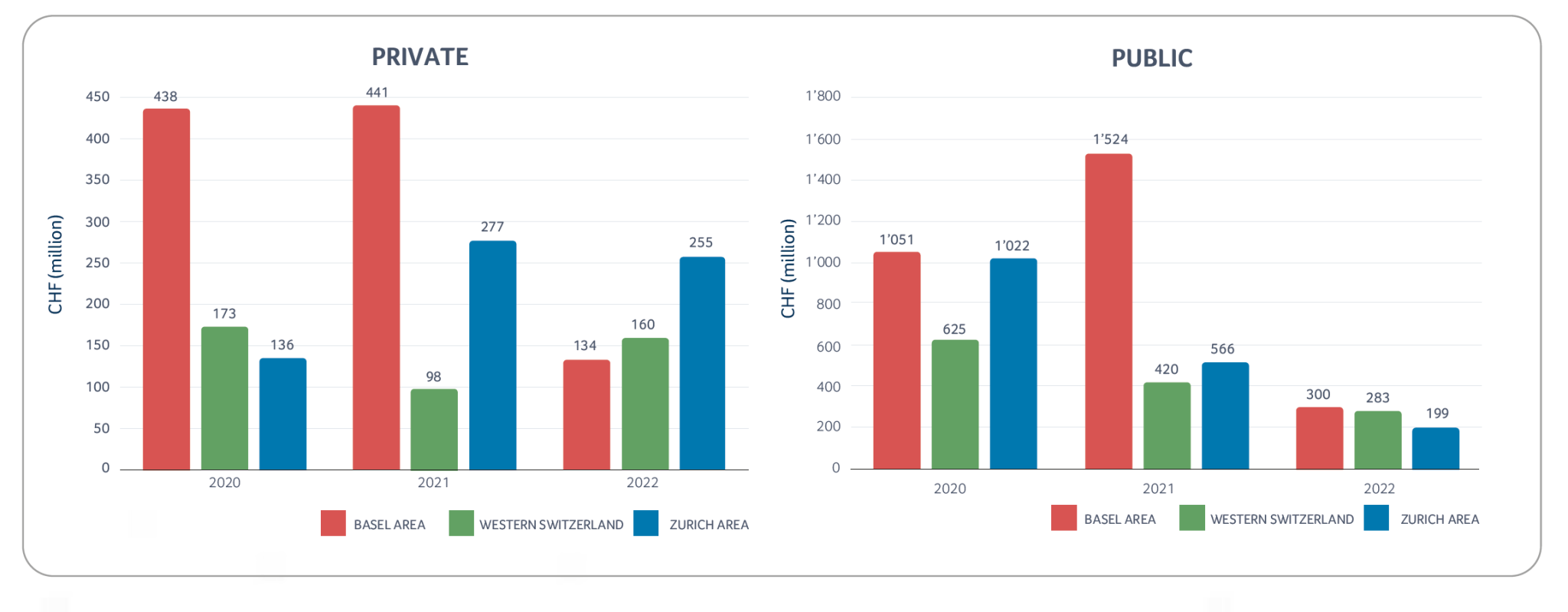

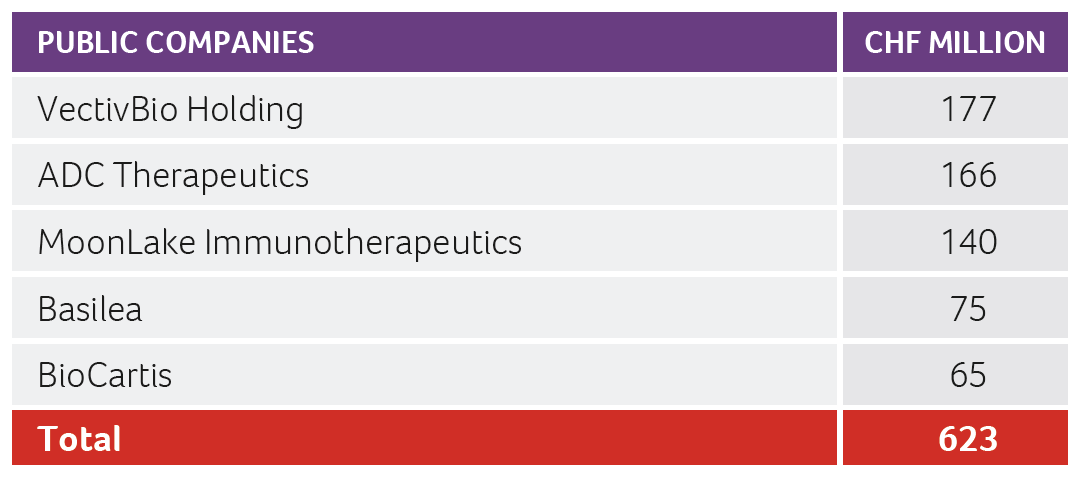

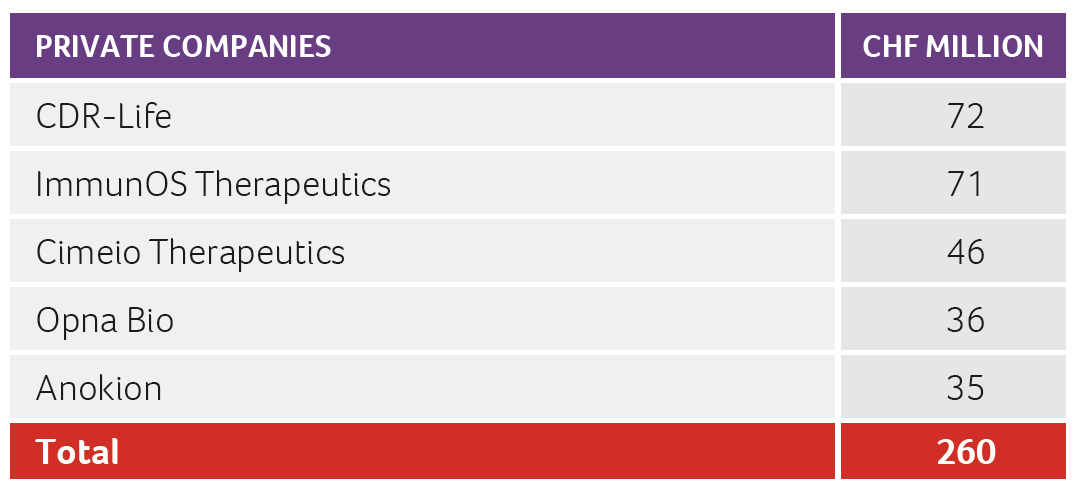

Despite the above-mentioned challenges, the Swiss biotech industry was able to raise more than CHF 1.3 billion in 2022, with roughly CHF 0.78 billion collected by public companies and the remaining CHF 0.55 billion collected by private companies. CDR Life with CHF 72 million raised, and ImmunOS Therapeutics with CHF 71 million raised, were the two largest private company financing transactions in 2022.

In addition, a number of successful European IPOs were announced in 2022, of which two IPOs involved either Swiss companies or used the SIX Swiss Exchange as a trading/IPO platform.

MoonLake Immunotherapeutics completed the NASDAQ SPAC transaction, which it had initiated in late 2021, successfully in early April 2022 and collected gross IPO proceeds of CHF 140 million. Kinarus went public at SIX Swiss Exchange through a reverse merger with Perfect Holding in early June 2022. VectivBio was able to gain additional funds from investors during two follow-on transactions (totaling approximately CHF 177 million). Additionally, ADC Therapeutics successfully placed a convertible bond of CHF 166 million.

Last but not least, in late 2022, Oculis also started its preparation for an upcoming SPAC transaction on NASDAQ. This transaction was successfully completed in early March 2023.

Since equity and debt markets were more difficult to access in 2022, it is remarkable how agile Swiss biotechs were in terms of finding alternative ways of financing. For example, there have been several large licensing and collaboration transactions (e.g., Molecular Partners, VectivBio, Numab Therapeutics, Novaremed, ObsEva), but also sale and leaseback transactions (e.g., Idorsia), both of which provided significant non-dilutive financing to the sector in 2022.

M&A and collaborations

Swiss companies were involved in several significant M&A transactions:

- Creoptix joined the Malvern Panalytical team in England

- NEC acquired Vaximm’s neoantigen vaccine development assets

- Ginkgo Bioworks acquired FGen and its ultra-high-throughput screening platform

- Relief signed a definitive agreement to acquire a novel dosage form of an already approved prescription drug for the treatment of PKU

- Basilea announced the sale of its preclinical oncology program to Nodus Oncology for up to CHF 242 million

- Versantis was acquired by GENFIT, combining forces to continue the development of its revolutionary therapeutics for patients with liver diseases

- Healiva acquired critical cell therapy manufacturing assets from B. Braun

Entering into new collaboration and licensing agreements was also important for several Swiss biotech companies, since some of those arrangements provided significant short-term attractive financial components. As mentioned above, these provided alternative means of funding (alternatives to equity or debt financing, which was more difficult to access in 2022). A selection of such collaboration and licensing transactions is shown below:

- Aurealis to receive up to USD 139 million in collaboration agreement with Xbiome

- VectivBio announced Japanese license deal providing up to USD 200 million for rare disease pipeline development

- Neurimmune enters global collaboration and license agreement with AstraZeneca to develop and commercialize NI006 for treating transthyretin amyloid cardiomyopathy

- Numab signed a CHF 258 million deal with Ono Pharmaceutical

- MoonLake Immunotherapeutics and Stalicla geared up for Phase II clinical studies

- Perseo pharma and Nestlé Health Sciences agreed a global partnership

- Novaremed received USD 130 million in exclusive option and license agreement with NeuroFront

- MedPharm started a collaboration with Mosanna to develop a new drug to tackle metabolic obstructive sleep apnea

- CRISPR Therapeutics and Vertex announced global regulatory submissions for exa-cel for sickle cell disease and beta thalassemia in 2022

- Tigen exercised an option to further develop and commercialize a neo-antigen T cell product from the Ludwig Institute, CHUV and UNIL

- Memo Therapeutics announced the signing of a research and development collaboration agreement with Ono Pharmaceutical

- ObsEva announced the sale of its Ebopiprant license agreement to XOMA for up to USD 113 million

- SOTIO exercised an option for a novel antibody-drug conjugate from LegoChem Biosciences

Product developments

In a positive vein, 2022 saw a similarly high number of regulatory approvals compared to previous years. More specifically, the EMA approved 89 new drugs in 2022 (2021: 91 new drugs) and the FDA approved 37 new drugs (2021: 50 new drugs).

Among the new FDA approvals, there was one drug that warrants being called out separately: Idorsia gained approval for QUVIVIQ™ (daridorexant) for adults living with insomnia. This is their first drug to gain approval since their creation following the Actelion / J&J transaction in early 2017.

The level of approvals granted by Swissmedic was slightly above the previous year with a total of 47 new drugs (2021: 45).

Awards

Several Swiss biotech companies received various prestigious awards throughout 2022. Noteworthy are three female laureates, which is a great testament to the success of female leaders and entrepreneurs in the Swiss biotech sector. These winners were:

- Aenne Burda award: Andrea Pfeiffer (AC Immune)

- Innovator of the year: Stefanie Flückiger-Mangual (Tolremo)

- Prix Suisse award: Martine Clozel (Idorsia)