- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Thursday, May 3, 2018 @ 12:00 am

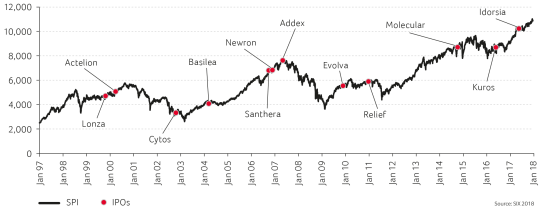

An IPO is a veritable option for funding biotech companies. This has been proven by the successful listing of a number of companies on SIX Swiss Exchange in the past two decades.

Christian Fehr

Relationship Manager, Primary Markets, SIX Swiss Exchange

The success of Lonza going public in 1999 paved the way for the Actelion listing on SIX Swiss Exchange in the following year. Actelion pioneered biotech company listings and it became the largest European pure-play listed biotech firm over time. In 2016, the Actelion success story culminated in a USD 30 billion takeover bid by Johnson & Johnson.

Today, SIX Swiss Exchange is one of the leading biotech exchanges in Europe and it hosts the highest capitalized European biotech company. Things started to take off following the Cytos (now Kuros Biosciences) IPO in 2002. In the period 2004 to 2007, SIX Swiss Exchange welcomed four new biotech companies: Basilea, Santhera, Newron and Addex. And it was also around this time that the SXI Bio+Medtech Index was created, underpinning the strong commitment of SIX Swiss Exchange to the biotech sector.

After the listing of Evolva and Mondobiotech (now Relief Therapeutics) in 2009, there was something of a break in biotech listings and then Molecular Partners in 2015 heralded a new era. The most recent listing was Idorsia, the company spun off as a contribution-in-kind to the former shareholders of Actelion. It was listed in the summer of 2017.

In summary, a dozen biotech companies listed in the time- frame and they aggregated a market capitalization of around CHF 25 billion at year-end 2017. There have been other impressive examples of listed companies in the space, which are not counted in this number. For instance Cosmo, which over time developed from its biotech origins into more of a pharmaceutical company.

The prominent global pharmaceutical players Novartis and Roche feature in the issuer base of SIX Swiss Exchange and they lay the foundation for a well-diversified peer group whose strong appeal reaches far beyond Switzerland’s borders. It therefore comes as no surprise that SIX Swiss Exchange ranks as Europe's most important life science exchange and leading biotech listing location.

“It’s very important for Idorsia to be quoted on the same stock exchange as big companies such as Novartis, Roche but also Lonza, many suppliers and many companies involved in biotech.”

Jean-Paul Clozel, CEO Idorsia

Switzerland’s capital-rich investor base, powerful banking system and its industry expertise make up the country's dynamic life sciences ecosystem. This allows companies to efficiently raise capital with a view to driving scientific discovery through to market launch. The Lonza experience is proof of this as are the other SIX-listed biotech companies which raised more than CHF 200 million equity capital in 2017.

“Successful IPOs and capital raised in 2017 confirm the deep pools of capital available in Switzerland. For example, Lonza raised over CHF 3.1 billion in two capital increases which marked the largest equity funding by a SIX Swiss Exchange listed non-financial corporate last year.”

Thomas Zeeb, Head Securities and Exchanges SIX Swiss Exchange

How SIX Swiss Exchange supports listed biotech companies

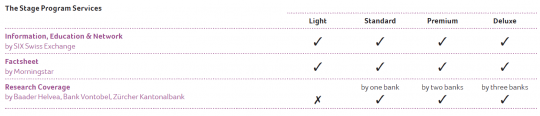

Achieving trading liquidity and adequate analyst coverage has become more challenging given the increase in regulations. As a result, listed biotech companies need to recognize that these are important issues and address them accordingly. Alongside other initiatives, the SIX Swiss Exchange Stage Program provides the means for doing so.

One of the most important reasons for listing on an exchange is the facilitated access it gives to the capital market and therefore to growth capital. However, to use capital markets effectively, a company needs to have a minimum volume of trading liquidity. Shares of small and medium-sized companies are often less liquid for a variety of reasons.

SIX Swiss Exchange offers several services and initiatives such as the Stage Program to support companies in the process of building their presence in the market and achieving an appropriate valuation. Companies benefit from a regularly updated factsheet and research reports prepared by experienced partners and can thus reach a larger number of capital market participants.

“We were the first company to join the Stage Program in 2016 and have noted increased investor awareness and interest due to the additional analyst coverage, since.”

Stefan Weber, CEO Newron

Through SIX Swiss Exchange, companies also gain access to statistics and services that facilitate the “Being Public”. To guarantee the independence of the reports and strengthen the trust of investors in the research, no contractual relationship exists between the listed company and the research provider. SIX Swiss Exchange acts as a link between the two. In addition, a research committee has been set up to ensure the interests of the different parties are taken into account. It is an advisory body to SIX Swiss Exchange.

SIX Swiss Exchange

SIX Swiss Exchange is one of the most important European stock exchanges. It offers outstanding liquidity in trading of Swiss securities and connects companies from around the world with international investors and trading participants. As a self-regulated exchange, it is able to provide particularly market-friendly conditions for listing and trading in Swiss and foreign equities, bonds, ETFs, ETPs, funds, and structured products. SIX Swiss Exchange multiplies the locational advantages of the Swiss financial center with first-class services and is an ideal listing location for companies of every origin, size and sector. It operates its own range of indices, which includes the SMI®, Switzerland’s most important equity index. For further information visit https://www.six-swiss-exchange.com and https://www.six-structured-products.com.