- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

The Swiss biotech industry is innovative, internationally connected, and versatile. It owes its strength to its ability to innovate in collaboration with global partners and evolve with changing market dynamics.

Michael Altorfer

Swiss Biotech Association | CEO

Marta Gehring

Swiss Biotech Association | Special projects

A history of strategic metamorphosis

In 1921, dye manufacturer Sandoz (now a division of Novartis) recognized the uncertainties facing the industry and after announcing its decision to diversify into pharmaceuticals, began to develop chemical dyes and pigments derived from natural sources.

Roche and Ciba (now Novartis) built their first US factories in 1927 and 1936 respectively. One of the world’s first global biotechnology companies, Biogen was founded in Geneva in 1978. Novartis was then created in 1996 through a merger of Ciba-Geigy and Sandoz.1

These are early examples of what was to come: drug companies using mergers to innovate, bolster product portfolios with external innovation, and work more efficiently. The Swiss drug industry thinks globally and acts locally, and has been doing so for over a century.

Also the research activities have been wide ranging, pioneering, and agile. Swiss Nobel Price winners in chemistry, physiology and medicine have been shaping some of the most fundamental discoveries which continue to have a significant impact on innovations that improve the global healthcare system today. These include: vitamins (1937), cortisone (1950), drugs that block the actions of specific neurotransmitters (1957), restriction endonucleases (1978), nuclear magnetic resonance (NMR) methods for studying biological macromolecules (2002) and cryo-electron microscopy (2017).

This ability to continuously evolve, from natural pigments to chemical synthesis to biotechnology, has shaped the healthcare landscape in Switzerland and around the world. By remaining outward looking, Switzerland has managed to stay ahead of the curve. Evolution and adaptation to global demand patterns have clearly benefited the industry and its ecosystem.

Big pharma’s desire to complement its internal product portfolio by in-licensing and acquiring innovative products from external partners has been matched by a boost in Swiss biotech innovation hubs’ output of innovative drugs. At the same time, increasingly diverse modalities have spearheaded a broader range of therapeutic options.

With a population of just under nine million, Switzerland is home to many globally recognized companies and research institutions, and is a world-leading biopharma innovation hub. The country continues to be a key player in shaping innovation of the global healthcare system and does so in close collaboration with its international partners. Consequently, it has been the source of a number of multiple first-in-class and therapies in oncology, CNS treatments, pulmonary arterial hypertension and infectious diseases - breakthroughs that have had a major impact on global health problems and have greatly improved patients’ lives. Gleevec® (imatinib) for cancer, Rebif ® (interferon beta 1a) for multiple sclerosis, Tracleer® (bosentan) for pulmonary hypertension, Kymriah® (tisagenlecleucel/CAR-T) for lymphoblastic leukemia, and the Ebola treatment (Ebanga™) are just but a few examples of breakthrough Swiss biotech innovation.

The country has a strong focus on research and development, a highly skilled workforce, and a favorable business environment characterized by highly efficient processes and minimal bureaucracy. This encourages innovation and investment in the biotech sector, making it highly productive without the need for government subsidies.

This collaborative productivity among different players in the biotech innovation ecosystem has been mastered in Switzerland and is critical to its success. The development of a new drug requires high, early-stage investment with no guarantee of clinical trial success. Phase III trials also require high investment and an ability to navigate complicated regulatory and market access pathways capabilities that only larger multinationals typically have.

These factors have created a dynamic industry profile in Switzerland whereby smaller, creative “emerging biotech” companies fund much of the innovation which is subsequently picked up by multinationals in Switzerland or elsewhere. Big pharma’s reduced innovation capacity has been matched by a boost in Swiss biotech innovation hubs’ output of innovative drugs.

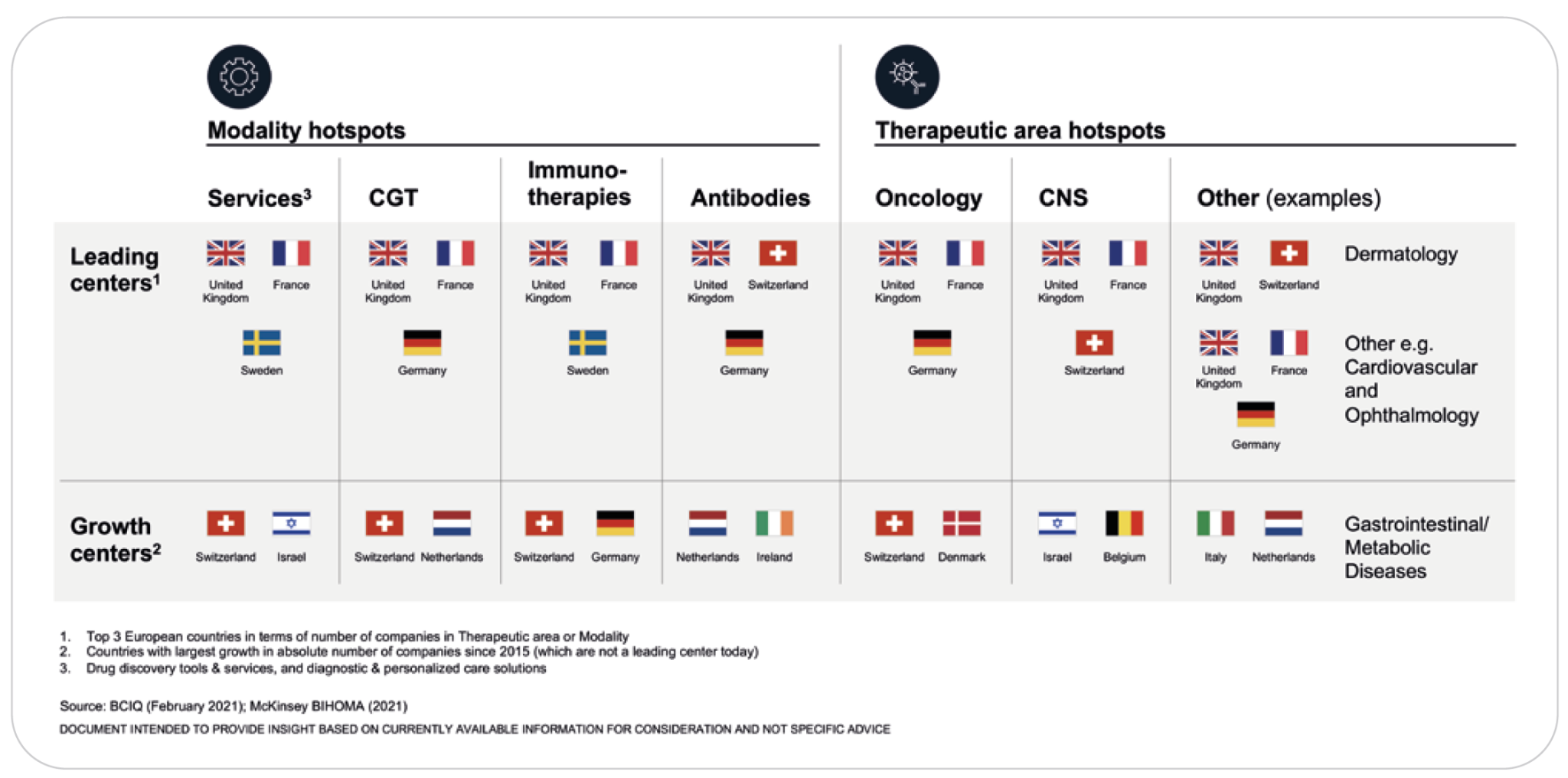

At the same time, the expansion in the diversity of modalities has spearheaded a broader range of therapeutic options. Switzerland’s growth in modalities is shown below (type of molecule and developer versus service provider). Switzerland is a growth center for services, cell and gene therapy and immunotherapy and a leading center for antibody R&D and manufacturing.2

In all modalities and in key indications, such as oncology and CNS, Switzerland is either a leading or a growth center

Switzerland’s outward looking innovation capacity

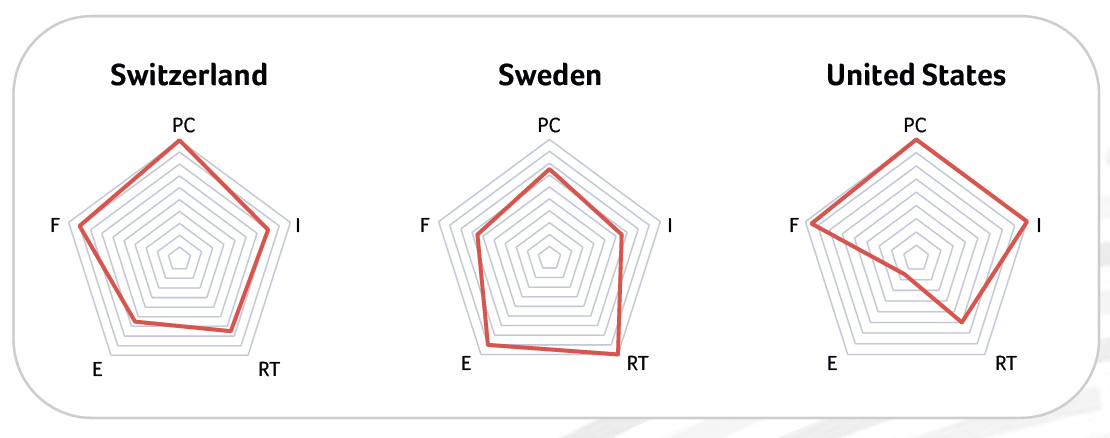

The finance and resource-intensive ‘R&D-driven’ model of biotech has been mastered in Switzerland. As a result, the Swiss biotech industry is one of the most advanced and innovative in the world. Using very different methodologies, the World Intellectual Property Organization’s Global Innovation Index 2022 and Nature Biotechnology’s The Worldview national ranking of health biotech sectors (2022) both found Switzerland, the USA, and Sweden to be leading centers for R&D-driven biotech.

Additionally, in Nature Biotechnology’s 2022 report (The Worldview national ranking of health biotech sectors3) Switzerland is in the top ten in nine out of 10 categories. It is no surprise then that Big Pharma is scrambling to acquire Swiss assets early in the development process: a recent review found that between 2005 Figure 1: Modality and therapeutic area hotspots in Europe, 2021 (reproduced with permission of McKinsey). In all modalities and in key indications, such as oncology and CNS, Switzerland is either a leading or a growth center and 2020, 33% acquired companies’ lead asset was just in Phase II. A large proportion of these acquisitions focused on oncology (30%) and CNS (16%), which are particularly strong in Switzerland.

(reproduced with permission of Nature Biotechnology). Pillars delineate strengths - from

top clockwise: Public Biotech Companies (PC); Investment (I); Research and Translation

(RT); Education (E); Fundamentals (F).

A global research hub developing tomorrow’s drugs

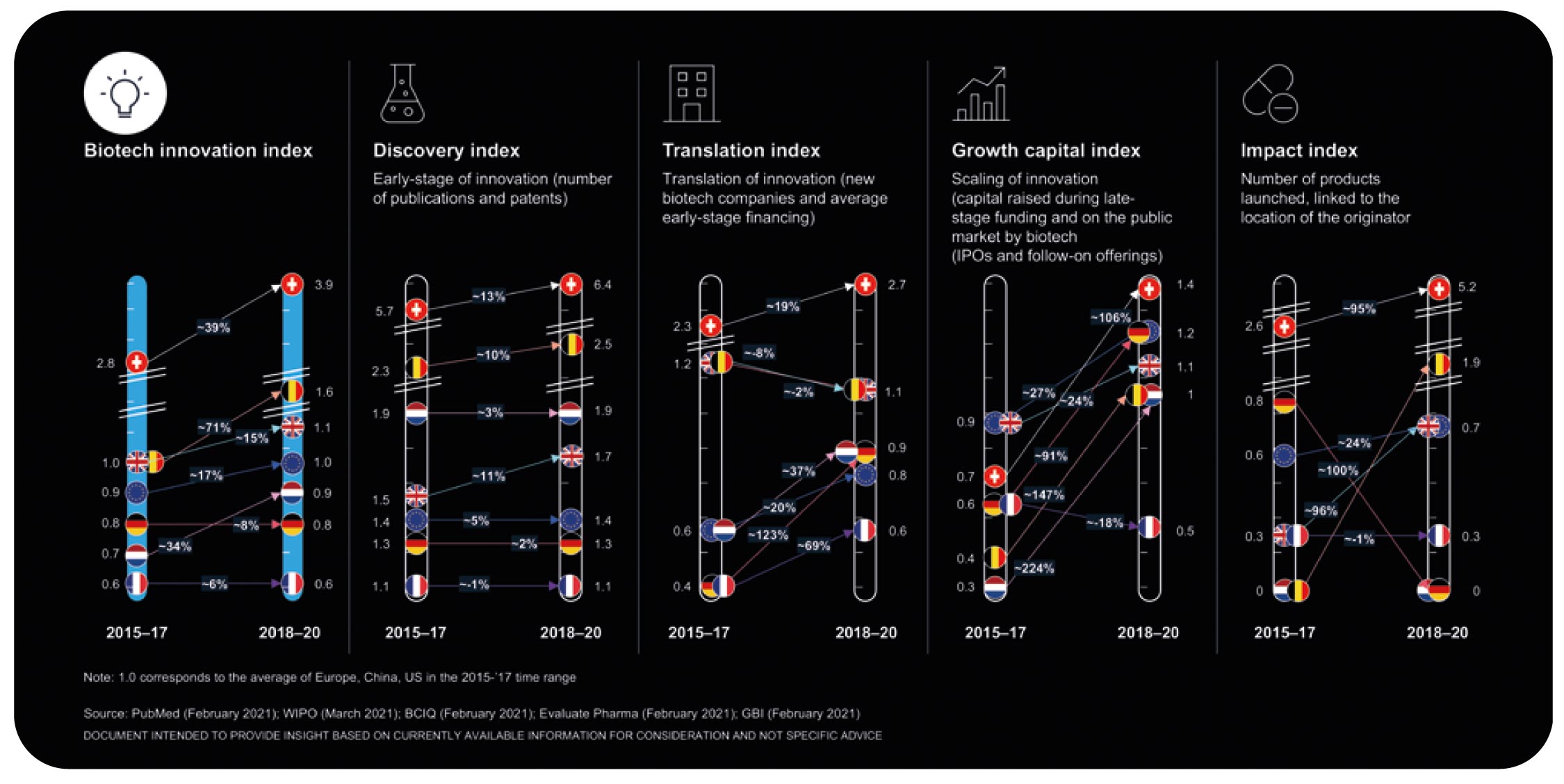

Switzerland continues to make improvements in its growth rate across all biotech innovation areas, even when starting from a high base.

Switzerland fares well in discovery (early-stage innovation), translation (creation of new companies supported by early-stage financing), growth capital (late stage and public market funding) and impact index (number of launches). This means that it has progressed in all areas in the five-year period 2015-2020 (see Figure 3). This is promising for the development of tomorrow’s drugs.

It is not always easy to continue to make improvements when starting from a high base. Yet Switzerland’s attention to global market needs, its disciplined R&D, collaborative ecosystem, and its access to capital and talent have allowed it to continue to improve across all biotech innovation dimensions, from early innovations to launch impact.

Swiss industry’s dedication to biotech and Switzerland’s ability to grow and develop its vibrant ecosystem is unwavering and the results speak for themselves. The summary Biotech Innovation Index (above) indicates that Switzerland is once again ranked number one. Such continuous innovation will bring increasing benefits to global health systems and individual patients as we move towards a new era of precision medicine.

References

2. Innovation Hotspots to drive the next act in Europe BioEquity Europe, McKinsey Report, May 17, 2021 Page 29 and 89

3. https://www.nature.com/articles/s41587-022-01349-4# auth-John-Hodgson