- Get directions

- Leave a review

- Claim listing

- Bookmark

- Share

- Report

- prev

- next

- Wednesday, December 30, 2020 @ 12:00 am

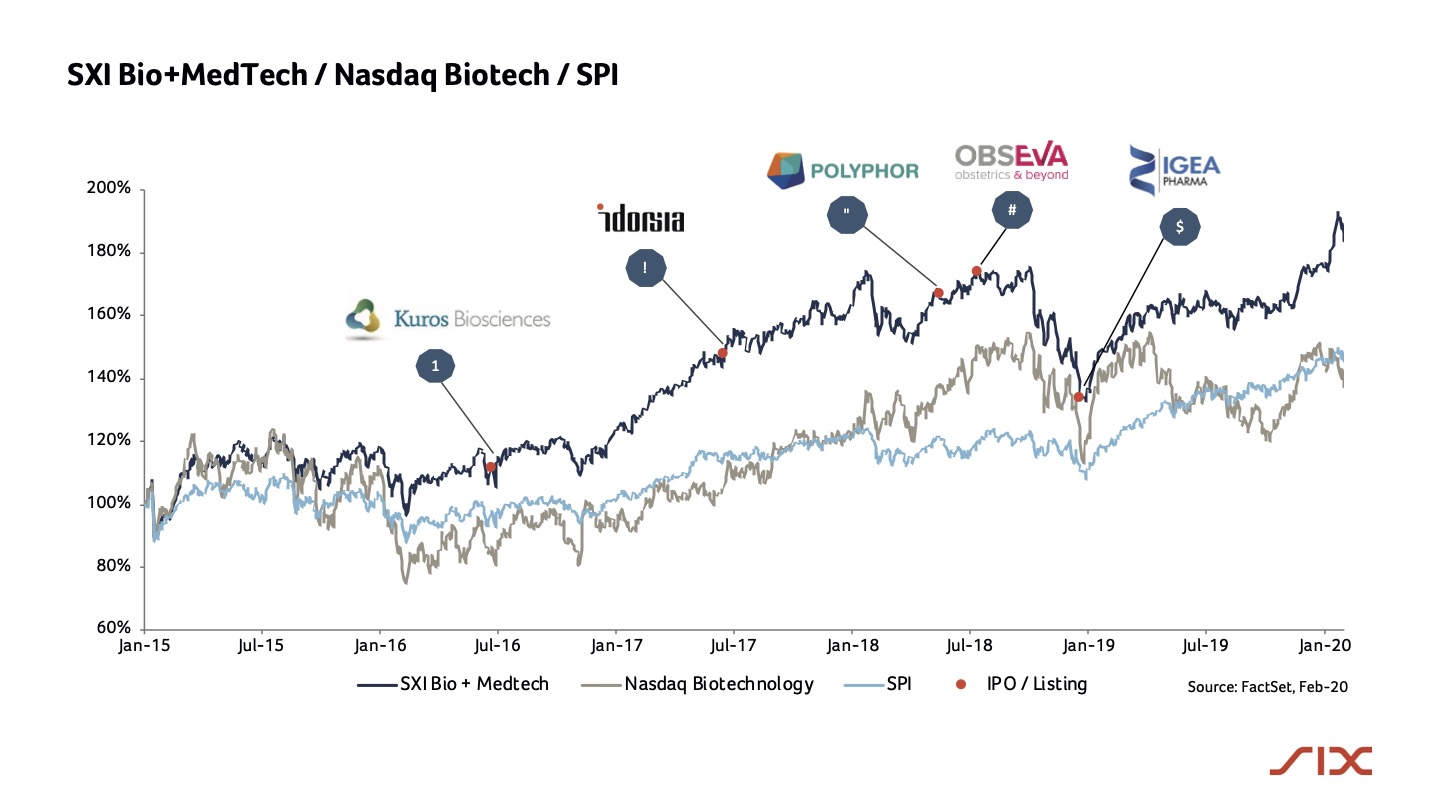

A look into the past, present and future of the Swiss Stock Exchange SXI Bio+Medtech Index indicates it has been outperforming its benchmarks in the last five years to January 2020 and the NASDAQ Biotech Index by 46 percent.

SIX is one of the leading biotech/life sciences stock exchanges and home to the most highly capitalized biotech companies in Europe. A special index - SXI Bio+Medtech - was created in 2004 to increase the visibility of biotech companies and to meet the needs of investors who wish to participate in this attractive segment. In 2016, SIX launched the “Stage Program” to support listed companies in expanding their market presence and visibility among key stakeholders, aiming to reduce uncertainty (and hence volatility) and better manage investors’ expectations.

High performer

Over the past five years to end Jan 2020, the Bio+Medtech Index has clearly outperformed both the Swiss Performance Index by 38% and the NASDAQ Biotechnology Index by 46%. This impressive development underlines the high quality of the listed biotech companies on SIX as well as the great interest of a large Swiss and international investor base.

The index currently comprises 19 companies. In the past five years, Idorsia (2017), Polyphor and Obseva (2018) were included. Polyphor was one of the largest European biotech Going Publics in recent years, enabling the company to raise CHF 155 million. Obseva undertook a dual primary listing on SIX, after its US listing, to further strengthen its profile among Swiss and European investors. This strategy provides Obseva with an additional robust market for future potential financing activities and allows to protect its shareholders through Swiss takeover rules.

The rewards of volatility

It is generally known that biotech stocks are subject to specific risks and thus susceptible to larger volatility of returns, both upward and downward. These include regulatory setbacks, clinical failure, commercialization challenges such as market access, and patent expiration.

However, the risk-return chart with selected indices for the year 2019 shows that in the case of the SXI Bio+Medtech, investors have been adequately compensated for higher risks taken. Compared to the NYSE Arca Biotechnology and NASDAQ Biotechnology Index, the risk-return profile is even highly attractive. Considering even a longer time horizon, the SXI Bio+Medtech succeeds in outperforming all benchmarks listed in the chart. This is also reflected in the Sharpe Ratio - also known as the Reward to Volatility Ratio - which has established itself as a widely used and recognized method of calculating risk-adjusted returns. With a 5-year Sharpe Ratio of 0.70%, the biotech index lies above the other indices.

Strong gains since 2019

Since November 2019, the SXI Bio+Medtech gained 15%, with several biotech stocks being among the best performing stocks in the SPI. Nevertheless, in the future volatility will remain higher than in other sectors, not least because of investors' high expectations.

This article is an updated excerpt from the Swiss Biotech report 2020 by Fabian Gerber, SIX, Senior relationship Manager Primary Markets